Stock options recording journal entries

Because stock option plans are a form of compensation, generally accepted accounting principles, or GAAP, requires businesses to record stock options as compensation expense for accounting purposes. Rather than recording the expense as the current stock price, the business must calculate the fair market value of the stock option.

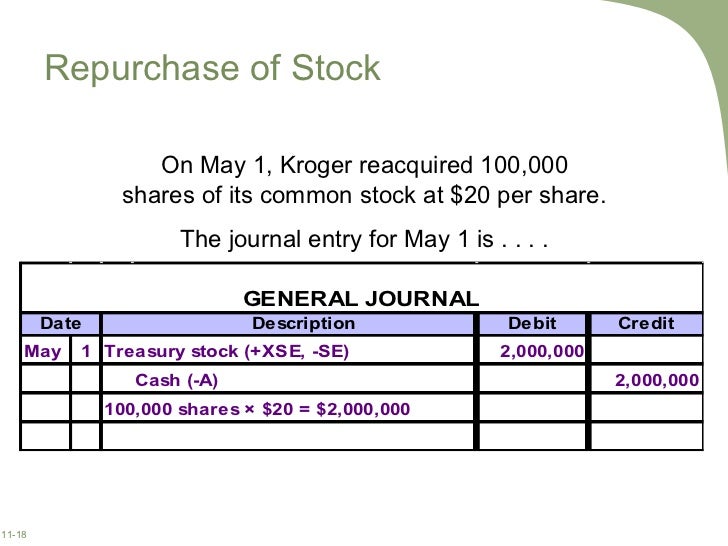

The accountant will then book accounting entries to record compensation expense, the exercise of stock options and the expiration of stock options. Businesses may be tempted to record stock award journal entries at the current stock price.

However, stock options are different.

Stock Options (Issuing & Exercising Options, Compensation Expense, Paid-In Capital Options)GAAP requires employers to calculate the fair value of the stock option and record compensation expense based on this number. Businesses should use a mathematical pricing model designed for valuing stock.

The business should also reduce the fair value of the option by estimated forfeitures of stock. For example, if the business estimates that 5 percent of employees stock options recording journal entries forfeit the stock options before they vest, the business records the option at 95 percent of its value.

Employee Stock Compensation

Instead of recording the compensation expense in one lump sum when the employee exercises the option, accountants should spread the compensation expense evenly over the life of the option. Accountants need to book a separate journal entry when the employees exercise stock options.

Accounting For Stock Compensation | Seeking Wisdom

First, the accountant must calculate the cash that the business received from the vesting and how much of the stock was exercised. An employee may leave the company before the vesting date and be forced to forfeit her stock options.

When this happens, the accountant must make a journal entry to relabel the equity as expired stock options for balance sheet how to make money flipping electronics. Although the amount remains as equity, this helps managers and investors understand that they won't be issuing stock to the employee at a discounted price in the future.

Say that the employee in the previous example leaves before exercising any of the options. The accountant debits the stock options equity account and credits the expired stock options equity account.

There are two major types of accounting in which a journal entry is made -- single-entry and double-entry accounting. By Madison Garcia eHow Contributor.

Stock option plans are recorded at the fair market value of the plan. List of Accounting Policies. Accounting for Stock Purchase Warrants. How to Depreciate an Automobile Under GAAP. GAAP Guidance on Salaries. Accounting for an Insurance Settlement.

Stock option expensing - Wikipedia

Free Printable Calendar And Weekly Inspirations for the Whole Year. About eHow Advertise Write For eHow Contact Us. Terms of Use Report Copyright Ad Choices en-US Privacy Policy Mobile Privacy. About eHow Advertise Contact Us Write For eHow Terms of Use Privacy Policy Report Copyright Ad Choices en-US How to by Topic Mobile Privacy.