Yesterdays stock market crash

Spot VIX was a lot more jumpy than front-month VIX; Volatility ETPs actually did their job pretty well yesterday. SPY continued the bullish climb that resulted from the Fed interest rate decision and press conference during its overnight session.

Just about every market had an initially bullish reaction to the news that the Federal Reserve would lift the federal funds rate by 25 basis points, which was widely expected going into the day. For more on the implications of the Fed rate hike and forward guidance given, check out our article from early yesterday morning.

Market participants will encounter another day of heavy data flow, with Housing Starts, Building Permits, and a bevy of Philly Fed information all hitting the wires before the open. To round out the day, the JOLTS report was released at around 10 EST. In a reversal from Tuesday's action, the energy sector NYSEARCA: XLF came in as the only laggard, dropping 0.

We found this performance quite interesting, as the financial sector arguably has the most to gain from higher interest rates. Today our article highlight goes to a recent Lance Roberts piece, titled " The World's Second Most Deceptive Chart ". In a continuation piece from an article he penned last week see " The World's Most Deceptive Chart "the author prominently features a commenter's response to charts displayed in first article, and offers a thoughtful rebuttal.

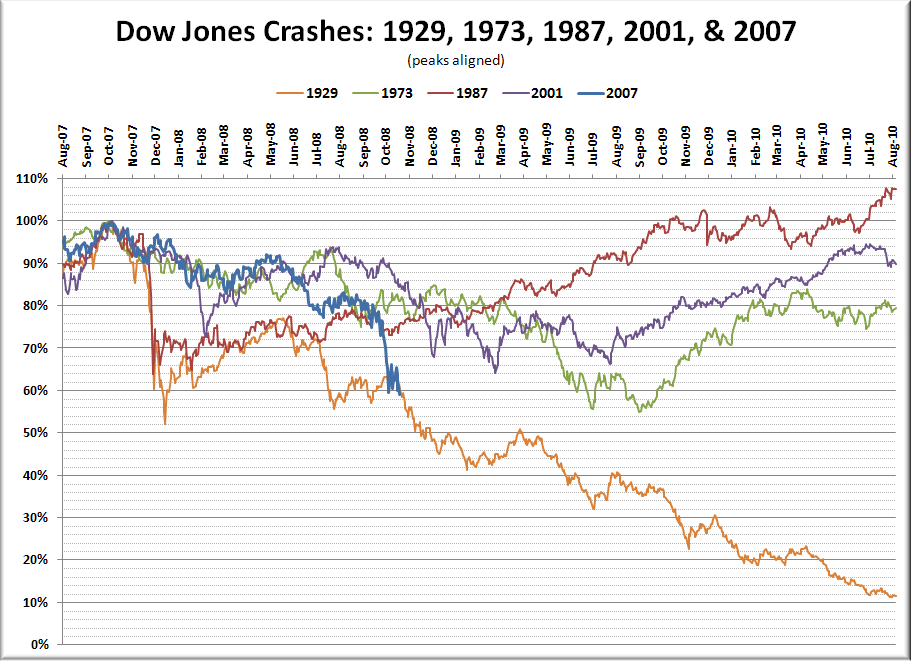

Though when combined, the articles do take some time to get through, we highly recommend interested readers look at the pieces together. Roberts' first piece discusses the deception present when looking at percentage gains and losses versus actual point losses when looking at stock performance during bull and bear markets. Displayed below is what the author has named the world's most deceptive chart.

Though the author delves into much greater detail, the biggest problem, he says, with the chart above is the deceptive nature in which it shows returns during bear markets. The red lines denote the number of years required to get back to even following a bear market.

Like the first chart, at first glance, this seems to really bolster the argument of those pushing a "buy-and-hold" approach to accumulating wealth in the financial markets. Not so fast though, Mr. Roberts remarks, as he walks readers through the realization that many investors may only have somewhere in the realm of years of prime investing years before death.

We truly do recommend that readers take the time to look at both of Mr. Roberts' recent pieces, though for those that simply don't have the time, we offer the following advice: After the widely-anticipated news came through the wires yesterday, we saw some interesting action in the VIX spot values, dropping briefly under 11, and ultimately closing the day at Even given this roughshod volatility in the spot price, front-end VX futures both March and April expiry curiously exhibited almost no big movement at all.

Our view on this is that while some volatility is always expected around large news events, volatility traders viewed the interest rate decision and guidance given in the press conference thereafter as within the realm of expectations.

Yesterday we noted from Tuesday how much less the VX futures move to the upside than the spot values, and in almost a perfect inverse, let's look at how the futures moved versus spot on a big downside day. Though a bit more muted than Tuesday's overall movement, the screenshot above shows how much less the VX futures move in relation to spot VIX.

Even with March VIX expiration less than a week away, the contract exhibited roughly half of the movement that spot achieved. Clockwise starting top left: VXXXIVVIXMUVXY. To quickly recap the products above: For a more in depth look at the products above, click on the links below the visual for our articles including specific product overviews.

With the exception of the XIV, all of these products seek a positive directional exposure to the VIX. In an interesting change of pace, observe how the VXX showed much more movement than normal, even to the point where it arguably delivered the closest replication of spot VIX movement yesterday.

Also tracking well was the UVXY, though it went above and beyond the percentage movement, as leveraged products occasionally will do.

Though directionally, all of the products shown above achieved their stated directives, our view is that participants may be able to find better opportunities to capture VIX movement through the use of ES options. Regardless of how you choose to participate in the volatility market, make sure that you really understand the core drivers of your product.

We like ES options, and we how to earn money faster on virtual families 2 a very tight eye on the VIX and VIX qqq trading system curve.

Others use volatility ETPs, which is fine. We are just quite concerned that many people do not understand the essence of what it is they are trading or worse yet investing in: In yesterday's bulletin we began a new trade to follow over the next two weeks. Market internals appear to be getting sloppy. As of the morning after the Fed meeting, this thesis so far appears correct in terms of "sloppy movement", but wrong in terms of direction: So far we are still within the range of where we've been for the last couple weeks, but we're near the yesterdays stock market crash end and it is possible that with the Fed out of the way, we could get our new range.

To implement this strategy, we will work with a spread known as a "risk reversal". We'll refer to the spread as a "RR". In the Chicago trading pits, these are short-handed to being called "a risk". Buy an OTM put, sell an OTM call. That is the essence of the spread.

In retail these are frequently called "collars", but we here are using the terminology that is used in investasi forex trading indonesia trading pits: In fact, in Chicago terminology money makers indore collar is long a put spread, short a call: It has "unlimited downside", and it has more or less unlimited upside.

From a practical standpoint, the risks are fairly balanced, especially if facebook ipo stock options employee pre and adjusted properly.

TULLOW OIL Share Discussion | TLW Stock Discussion | Interactive Investor

Losses need to be considered relative to what the needs of the owner are and what other assets this particular individual has. This account is more of a way to learn trading and hedge losses. Well if that is the case then perhaps meaningful losses in the trade account are relatively acceptable. If on the other yesterdays stock market crash this is the one and only account that the trader has and they cannot afford to lose much, then this is really not the best way to trade their thesis: We could have used any number of spreads to express a bearish view on ES.

Let us have a look at the exposure to the Greeks on the spread that we chose:. Theta on this trade bottom row is currently a bit positive. Vega is a touch negative 5th rowand gamma says zero due to rounding, but the visual fact that our delta is heading in the wrong direction as we go higher shows that it is negative.

This is a very forex group gmbh bovenden profile from Querty's OTM put idea, as that position would have negative theta we'd pay time decaypositive vega, and positive gamma across all possible ES levels. For large and sustained moves in either direction, Querty's idea is the better of the two. For most other scenarios, the RR does better. As it turns out, at least for now Querty's proposal may have been the trading strategies madden 25 trade: ES futures are up about 20 points from where they were on Tuesday at the trade initiation.

Naturally that depends on which ES put he would have purchased and also whether he would have bought one or two. This underscores an important idea: Different spreads trade better or worse than others under different market scenarios.

This is why it is good to understand how all the major spread families work.

Stock Market Crash 2017-18It will by no means assure that you're "pick the best spread" - only that you'll choose the spread that lines up best with the way you wish to gain exposure. This RR spread presumes an investor who was considering a raw short ES futures position, but wanted something with a bit more give to it; a spread that mostly acts like a futures, but with modest positive exposure to implied volatility, and some attractive gamma should the trade actually go right.

We are tempted to make some kind of move here, and if ES moves toward we will. Good on them if the market tanks, but how wrong you're willing to be in the meantime comes down to one's personal circumstances, risk aversion, other holdings, and so on. For now, we'll just say that the RR was bound to be less wrong that a short futures position if ES rose which it didand also less right than a short futures position if ES fell.

Because we track a trade for a couple weeks for educational purposes, we tend to stick to the same overall spread. In reality, this may be quite a good time to consider moving to something else. We will say that with the modest positive theta and negative vega, the market pays us though likely not much if ES just languishes here.

U.S. Stock Market Data - Dow Jones, Nasdaq, S&P - CNNMoney

Tons of ways to do it. But what we'd likely use is another RR that was long a deeper OTM call, short a deeper OTM put. For instance, the May5 RR sell the put, buy the call.

That could be an effective tool if the trade had you nervous, and not at all an imprudent move at this time.

Equity markets seemed to like the Fed's message yesterday, though the XLF, which would most benefit from hikes, was the only sector that underperformed. Spot VIX had a "flash crash" move on the Fed release, but popped up and is still keeping its head above the Our ES trade is down and we are near the mark where we should think hard about modifying the trade, but we'll say we're not quite there yet.

Regardless of whether you are a "trader" or an "investor" whatever those words mean! Have any questions or suggestions? We really enjoy reader comments, and post strong comments from our readers with regularity. Please consider following us.

And check out our commentary on today's Fed decision! I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article. We actively trade the futures markets, potentially taking multiple positions on any given day, both long and short. As such, we typically carry a net short position using ES options and futures.

Portfolio Strategy Fixed Income Bonds Financial Advisors Retirement Editor's Picks. VIX Licks Its Wounds After Yesterday's Flash Crash Mar. The Balance of Trade. Summary Equity markets mostly cheer the Fed's decision, with some interesting sector dynamics. Tracking our ES position.

Can You Really Earn 8,% from the “Internet of Cars?” | Stock Gumshoe

Wednesday Close Market participants will encounter another day of heavy data flow, with Housing Starts, Building Permits, and a bevy of Philly Fed information all hitting the wires before the open. Want to share your opinion on this article?

Disagree with this article? To report a factual error in this article, click here. Follow The Balance of Trade and get email alerts.