Average length bull stock market correction

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Panic has hit Wall Street and Main Street -- or at least that's what the financial headlines would lead you to believe.

Unless you were a noted short-seller of stocks, it probably wasn't a good week. The closing price for the Dow also signaled its first official correction since With the Dow sitting almost 1, points off its all-time high set back in May, the Dow has now shed What you should know about a stock market correction However, a stock market correction isn't necessarily a bad thing depending on the context you view the correction from.

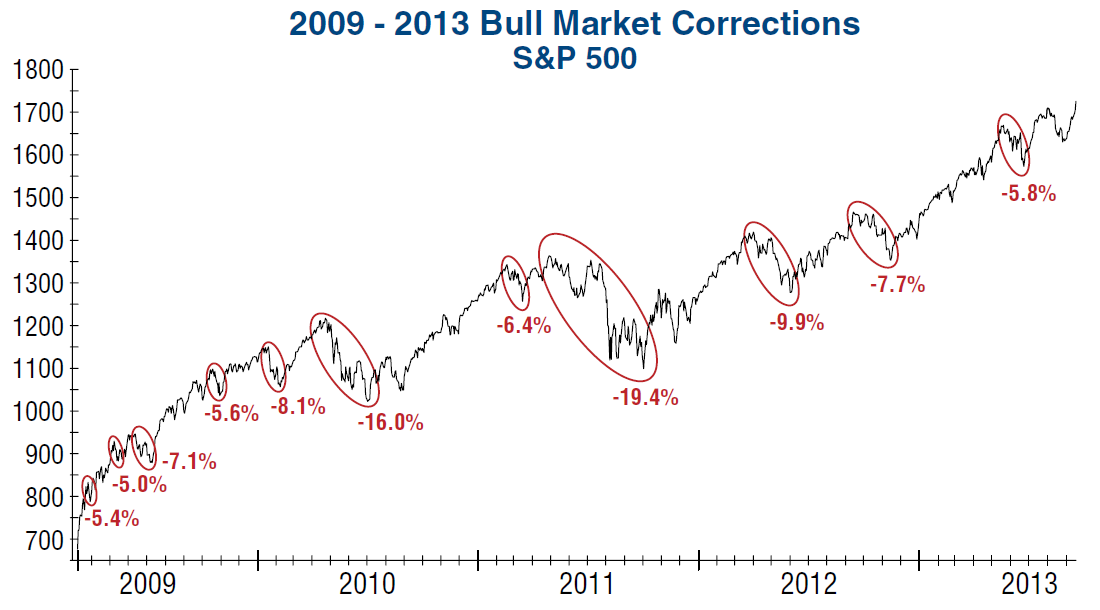

Here are six important things you really should know about a stock market correction. Stock market corrections happen often The first thing you should know is that stock market corrections happen -- and fairly often.

According to investment firm Deutsche Bank , the stock market, on average, has a correction every days, or about once a year. Our last correction was nearly 1, days ago, the third-longest streak on record. For those curious, we went around 1, days without a correction in the mids. Long story short, corrections are an inevitable part of stock ownership, and there's nothing you can do as an individual investor to stop a correction from occurring.

Stock market corrections rarely last long In a broader context, while a stock market correction is an inevitable part of stock ownership, corrections last for a shorter period of time than bull markets.

Based on research conducted by John Prestbo at MarketWatch on the Dow between and , Prestbo determined that the average correction which worked out to Not counting our most-recent dip in the Dow, corrections in this century have averaged In other words, stock market corrections often tend to be on the order of a few weeks to two quarters in length. We can't predict what'll cause a stock market correction A stock market correction may be inevitable, but one thing they aren't is predictable.

Stock market corrections could come about within any timeframe every few months or after multiple years , and they can be caused by a variety of issues. For instance, we now know the impetus for the Great Recession was the bursting of the housing bubble caused by an implosion of subprime mortgages.

But, how many people were echoing that subprime was a problem in or ? The answer is very few people were. Predicting the root cause of the next correction on a regular basis just isn't possible.

Stock market corrections only matter if you're a short-term trader Another important point you should realize is that stock market corrections really aren't an issue if you remain focused on the long-term with retirement as your goal. The only people who should be worried when corrections roll around are those who've geared their trading around the short-term, or those who've heavily leveraged their account with the use of margin.

Traders using margin could see their losses magnified in a downturn just as their gains were pumped up during the bull market , while active traders and day-traders could see their losses and trading costs build during a correction.

Maintaining a long-term view has been the smartest way to invest in stocks throughout history — and it also happens to be a recipe for a good night's sleep. They're a great time to buy high-quality stocks at a bargain For the long-term investor, a stock market correction is often a great time to pick up high-quality companies at an attractive valuation.

Take Gilead Sciences NASDAQ: GILD , the maker of revolutionary once-daily hepatitis C therapies Harvoni and Sovaldi, as an example. A stock market correction isn't going to impede the desire of HCV patients to get treated — there are an estimate 3. Perhaps it's time for investors to take a closer look? Gray lines represent periods of recession in the United States.

But, it's not just Gilead. Those odds are certainly in your favor over the long run.

How to Handle Stock Market Corrections

They're also a good reminder to reassess what you own Lastly, a stock market correction is a good reminder for long-term investors to reassess their holdings.

As noted above, a dip in stocks isn't necessarily a bad thing as it could give you the opportunity to buy or add to high-quality companies; but it's important that you reassess your holdings to ensure that the thesis of your purchase remains intact. Ask yourself one simple question with each stock in your portfolio: Is the reason I bought this stock still valid today?

If the answer is "yes," then no action is required, other than perhaps adding to your position. If your thesis is no longer intact, then it may be time to consider selling your position. A stock market correction doesn't have to be scary as long as you keep the aforementioned six points in context. If you think you have what it takes to invest in stocks in good times and bad, head on over to our Broker Center to get started.

The Motley Fool owns and recommends Gilead Sciences. Try any of our Foolish newsletter services free for 30 days.

Small Cap Leader - Free NASDAQ Stock Picks and Small Cap Stocks

We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. Skip to main content The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Stocks Premium Services.

Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks.

Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford?

Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep?

Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Here are six things you should be aware of when it comes to stock corrections.

Flickr user Search Engine People Blog. How to Invest in Stocks. Prev 1 2 3 4 Next.