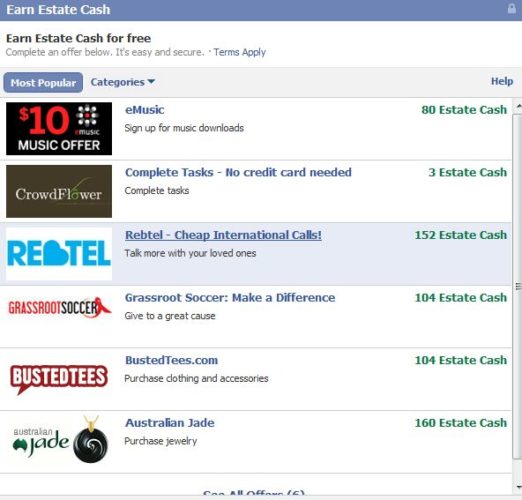

How do i get estate cash in hidden chronicles

Back inwhen I was a real estate agent for six months in suburban Chicago, my last sale before I moved to Appraiserville was almost crushed by an old, very used, rider mower.

The buyer wanted it, and the seller was sentimentally attached to it. The seller stood firm, and luckily the sale went through. I doubt if the homeowner below would throw in a lawnmower as a deal-sweetener when the time came to sell.

Even though rates edged up a little after the Fed announcement, in context they remain lower than they were on January 1st.

Because banks borrow short term and lend long term, and bond traders still think the Fed is harming future economic growthas evidenced by the yield curve i. With less wiggle room, I suspect this will cause mortgage underwriting to tighten or remain tight which is not good for the housing market if we want it to normalize. Since land costs are the reason housing is expensive, how does the purchase of modular housing resolve this problem, unless Google already owns a bunch of land?

I suspect the problem will become much more significant in urban markets are housing construction there is relatively inelastic. The problem in tracking these sales is that they are often blended with the residential sale.

I believe it has been on the market for about four years. In fairness, construction was only completed a year and a half ago, and current buyers do not purchase off of floorplans. I wonder if some developers are holding tight on pricing for exceptional units, for now, hoping the next market arrives sooner than later.

However, the brief post-election sales bump turned out to be a false-positive, and Manhattan luxury sales activity has cooled considerably in recent months.

Games | Play Games Online | WildTangent Games

After a snarky trying-to-be-coy blog post that tried to win on a technicality that there was an appraiser shortage, many appraisers, including myself, took to the streets the comments section to voice our outrage. In response to the blog post outcry by the appraisal community, HW editor-in-chief Jacob Gaffney reached out and asked me to write a rebuttal.

To his credit, he got our message and promised to do a better job covering both sides of appraisal issues. Tough way to lose, bro. In my Matrix blog post on this rebuttal, I inserted a cool chart that was presented in a prior Housingwire Webinar that also includes the infamous AMC owner Brian Coester — who blocked me on Twitter after the webinar I feel honored.

I add this line of reasoning in the Housingwire story because I wanted to talk about the optics of the false narrative being pushed by AMCs. Not too long ago there was a webinar hosted by Housingwire that included some Powerpoint slides by one of the panelists, Matt Simmons. He is a Florida appraiser and former state regulator. He shared it with me, and one of his slides is quite amazing.

He matched mortgage origination volume with the federal registry of appraisers. The ratio of appraisers to mortgage volume has been higher since the housing bust than during the housing boom.

While the chart only goes toboth total origination and appraisers have changed little since then, so the ratio would remain stable, consistent with the post-financial crisis pattern. In other words, there are more appraisers now than there were during the Housing Bubble based on mortgage volume.

A colleague of mine asked me to pass along this survey on appraiser issues. There are only six questions and they focus on your day to day work experiences.

The results will be shared soon. If you need something rock solid in your life particularly on Friday afternoons and someone forwarded this to you, or you think you already subscribedsign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them. I got five hours of sleep last night so I needed some levity. Douglas Elliman just published my research on the New York City market, namely the Manhattan, Brooklyn and northwest Queens rental market.

The rental report itself covers new leases, not renewals. When this was published, I was thinking that there was no way that my rental market research could compete with the Comey Hearing in the U.

But hey, the coverage of our market report was the 7th most read story on the Bloomberg terminals world wide. And speaking of Bloomberg, here is a chart on the rise in new leases — both from consumers pushing back and rental price increases at renewal and more new development product entering the market.

That was a Not only was there a surge, but the median rent for those units jumped 8. With the introduction of larger, high end apartments into the mix, they do have some impact on aggregate price trends even when looking at median sales price.

These transactions also skewed larger apartment price metrics such as 2-bedroom and 3-bedroom units when on a unit for unit basis, those markets continue to weaken.

Newer higher quality units are continuing to obfuscate the rental market in general. With the heavy use of concessions, landlords are in danger of attracking too many renters that can only afford the rent if they are provided with concessions.

If for some reason the rental market rebounds and the landlords stop offering concessions, many existing renters will not be able to renew. Curbed has a great piece called: What happens to New York apartment-seekers when perks like free rent dry up?

Mortgage rates, which reflect future risk, are at their lowest level this year. Oh, and old-timey jobs are hot.

Apparently it is homeownership month. In this note to the NYT editorand I would suggest a more important discussion over debating the mortgage interest rate discussion, is the mobility of our work force.

With the decline in manufacturing, many workers are noit able to where the new jobs are. When my wife and I moved to Manhattan in from the midwest, it was a little dicey.

One of the more worrisome neighborhoods to perform appraisals was the Lower East Side of Manhattan. Squatters of the Lower East Side. The FT takes a great broadsweeping of the aftermath of the global super luxury development boom. June 13, — Real Estate Board of New York: Residential Brokerage Division Owners and Managers Breakfast: Thanks to Nancy Strong and Christine Haney for the actions shots! There are a number of legal and policy matters coming to a head these days after years of self-dealing by certain entities that benefitted from taking advantage of or simply beating down front line appraisers.

It has been painful to watch and experience but I am glad we are seeing things on the verge of coming to the surface. More on this in the future. I am cutting this short because I was out until 3 am last night despite being under the weather.

In the meantime, check out the Appraiserville links below, especially over at Appraisers Blogs. Specifically I was a darn good putt-putt golf player in my teens, and who knows whether I would have ended up as a pro putt-putt golfer if I knew about it, instead of a real estate appraiser.

I mean, putt-putt professional golf was disrespected for being a tiny low paid niche of a bigger sport, and appraising continues to be disrespected as a tiny low paid niche of the bigger real estate industry. So in the interest of transparency, I always went with an orange golf ball. Today I received a press release from Zillow that shared the results of their research with the headline: Numbers can be magic, especially when presented in an econ-sounding way. The consumer absorbs the results as gospel without challenge.

The problem here is that consumers take this information and run with it. There is a 30, square foot home listed for sale in New Jersey that has been off and on essentially on the market for 7 years. As I mentioned in the article, an excessive marketing time like 7 years suggests that pricing has not been close to market. The headline in the WSJ says it all: Or just directly to the Fed Beige Book and drill down by the member banks to get a regional anecdotal description.

Here are a few summaries for the banks whose regions overlap those of our Elliman report series:. New York Economic activity has flattened out in recent weeks. Labor markets remained tight, and wages for skilled workers have continued to grow moderately.

Input cost pressures have remained fairly widespread, while selling prices have increased at a modest pace. Housing markets have been steady, on balance, while commercial real estate markets have been mixed.

Atlanta South Florida Economic activity modestly improved. The labor market remained tight. Firms noted use of training programs to attract and retain workers. An uptick in wage growth was reported for high-demand positions. Retail sales were soft, however, sales of trucks and large vehicles remained solid.

Manufacturers noted increases in new orders and production. San Francisco west coast Economic activity continued to expand at a moderate pace. Overall, price inflation was steady. The labor market tightened further, and wage pressures grew moderately. Sales of retail goods grew modestly, and growth in the consumer and business services sectors remained strong. Manufacturing activity picked up to a modest pace. Activity in the real estate sector remained strong.

Lending activity grew moderately. Oh, and no matter how many time Fed FOMC members speak in public about strong economic growth and future multiple rate increases, mortgage rates are sliding. There was an interesting article in The Real Deal Magazine column: The concept is pretty straight forward. When you introduce ways to cut costs for homeowners i. We see this in other mechanisms like tax deductions or low mortgage rates.

In addition to the mortgage interest rate deduction, land use regulations also push prices higher. Zoning, land use regulations, tax incentives are embedded in that value. So if those incentives are removed, the value will quickly drop. In covering over 30 U. Here are some charts and copy I wrote to showcase this information from our research that was used in their marketing efforts.

Click to expand them. This week I am sitting in my D. I implore you to consume both riveting interviews:. Marc Andreessen, Venture Capitalist at A16Z [ link ]. TED — Elon Musk: The FTC Has Sided With the AMC Industry Rather Than All The Appraisers Those AMCs Have Gouged. Today was a historic day for the appraisal industry, and not in a good way.

The FTC made an announcement after what I heard was some hard lobbying by REVAA, to challenge Louisiana Real Estate Appraisal Board on restrictions that they say hurts competition. The Louisiana Board came right back at the FTC with their own release later in the day. Housingwire provides a summary of what we know at this point.

Skapinetz lawsuit, yet showed a willingness to report on this anti-appraiser announcement. Phil Crawford gives his always fascinating take on this FTC action and why it is a harbinger of tough times ahead for the appraisal industry. Apparently, we learned that big data can tell you what the best color of paint is for maximum value of your bathroom — even if you believe that, it cannot tell you that the house was occupied by cats.

I was taken aback by the self-serving press release from Corelogic that basically said appraisals are questionable and automated valuations are better. That makes sense coming from a data firm with their own AVMs. Part of the analysis that is missing — that contaminates the data pool — is the unending pressure appraisers are subjected to in the mortgage lending process, especially through AMC conduits.

I find it weird that this type of analysis was understaken without consideration of the administration pressure the current syste, places on appraiser professionals. Friday nights are pizza night at our house.

I remember seeing a lottery commercial a few years ago that explored what people would think about in all their spare time if they won the jackpot. One commercial showed a woman walking in a beautiful garden, contemplating the geometry of a pizza box. Admittedly, I thought it was pretty deep. After all, a slice of pizza triangle that is part of a pie circle that sits in a box square is kind of mindblowing…especially when I contemplate the round slices of pepperoni and parallelogram-like chunks of eggplant.

Apple, known for iPhones and MacBook Pros and their new saucer-like circle headquarters building…. And in the process, patented a better pizza boxalthough technically it is no longer a square box circle. And they are not speaking in public about it, so the plot thickens but not the crust. All I can say is that appraisers are constantly measuring different shapes every day. This is a deep and a good segway to the next Housing Note slice triangle.

I thought this was a pretty interesting point made by NAHB on new home sizes:. The Zestimate has been around now for more than a decade, filling a voyeuristic real estate need but without consistent accuracy.

And their former president once told me at a meeting in my office: She is now representing an area homebuilder who looks to make their case go to class-action:. Zillow has had more than a decade to build and improve them. The real issue is more about the varying quality of public record and the simplistic singular digit way they present the results to the public. NYC public record is a horror show yet in other markets with more homogenous housing stock the results are more accurate.

No wonder there are empty storefronts all over Manhattan. The celebrity premium is largely a myth. Pricing still needs to reflect actual market conditions. This is one of the reasons I have a hard time believing mortgage rates are going to rise much over the next several years no matter what the FOMC decides to do. Although the Forbes reporter was able to get the square footage estimate of around 8, from the broker, the figure is not presented in the listing as of this writing.

This seems odd since it is a new home and there must be fresh architectural measurements. Perhaps it was done to prevent ppsf comparisons to other sales? Still, I love this place. I am one of the board members of the new NY-CAP effort.

While the sound quality was a little choppyI learned a lot from the other speakers, John Dingeman and Creighton R.

Great information was shared and I soaked it up as someone new to the grassroots coalition movement. All appraisers I know are getting their shopping list together right now for some serious B-B-Qing this weekend.

You think that there is a lot of news and controversy coming out of Washington, D. Well, the appraisal industry is seeing just about as much Russia, aside so be sure to read through the supercharged edition of the Appraiserville section below.

However, when you find deep tracks in the housing market, they provide a complete context to the market or band you thought you understood. In this NY Fed Business Leaders Surveyyou can see how pronounced the pause in activity was late last summer into the fall before the U.

There was a listing with this description on Zillow. This listing says in full:. Please read carefully before scheduling showings. May not qualify for financing. Little is known about condition except that property has active roof leaks. Upstairs apartment cannot be shown under any circumstances. Buyer assumes responsibility for the month-to-month tenancy in the upstairs apartment. Occupant has never paid, and no security deposit is being held, but there is a lease in place.

Downstairs has 1, sq. Living room, dining room, and bedrooms have wood floors. Berber carpet in central hall. Insome electrical and plumbing were upgraded. Upstairs unit has sq. Backyard cottage has gas heat, sq. All units have been used as rentals at some point.

One of the reasons our housing market still remains distorted is because mortgage lending standards have not normalized. The credit scores for portfolio mortgage loans is incredibly higher than during the housing bubble era. This is why I contend that credit conditions for mortgages — unlike auto loans, credit cards and student loans, remaining irrationally tight.

Those odds seems fairly reasonable if not low considering their market kept on going after the U. Nobel Laureate and economist Robert Shiller connects the dots between housing data at the time and the price bubble through social narratives at the time — ie getting rich through flipping.

As the search for affordability increases, there has been an outward push in demand extending to the outer boroughs and suburbs. Sales since show prices far outpace building fundamentals: An interesting conversation with Justin Davidson, architecture critic for New York magazine on an article he wrote in This dovetailed nicely with a great Citylab piece I mentioned last week but still am reveling in the content: Why Do Autocracies Build Taller Skyscrapers?

Some Gramercy Park area residents in Manhattan have access to a beautiful 2 acre private park. Many years ago, New York City hired consultants to value direct access to the Highline for real estate purposes.

Remember that roughly two thirds of residents in many urban markets are renters despite the fact that two third of U. NYC is no exception it is a two-thirds renters market.

The rate appears to be rising — or at least not falling unabated. Notice the Fannie Mae projection made during the bubble? Sprinklers accidentally turned on and damaged three escalators at the 86th Street station on the new Second Avenue subway line. We New Yorkers love to complain. If the building is big, then a pool will likely have a nominal influence on your HOA fees. I remember appraising a loft-like townhouse in downtown Manhattan where a roof top pool was positioned directly above the master bedroom on the floor below.

In my own practice, we are seeing some rumblings on the AMC front that is encouraging for our industry. They are either not renewing their AMC agreements or requiring their AMCs to create high-end appraisal groups that cater to high-end mortgage loans.

The blowback from their own client base has been significant and they needed to take action. So far they have been very refreshing to work with. We no longer get stupid requests that wear us out; i. For excellent periodic insights, send appraiser Dave Towne a request to be added to his email distribution list: Many appraisers began circulating messages about and questioning this request, and the blogosphere and forums are now filled with various comments.

This is one key reason why I have major concerns about using the AppraisalPort delivery process. By the way, the. But the signature is on the PDF report that accompanies the. He also shares some suggested verbiage for appraisers to address various issues they run into. This verbiage came out today:. The Outside World Continues to Fail to Understand Our Role in the Homebuying Process.

From the Denver Post: His public reputation is one of absolute loyalty to the policies and practices of AI National, so it invites analysis to make sure a balanced message is conveyed. Here are my thoughts after reading this post. Full disclosure — Woody and I have a history. He has been critical of me in social media and behind the scenes with people I know.

I just wish he would rely on facts and not simply go with the default storyline of AI National. Critical thinking as a lucrative appraisal skill can apply to everyday life including the actions of a trade group or professional association.

His post title choice infers that AI National is in the middle of resolving residential membership issues.

Granted the committee has already been getting together to create recommendations for AI National to consider. This is great news. The decline in membership can be seen in charts from an earlier post on REIC.

Because AI National membership decline is faster than market forces facing the industry, it is reasonable to suggest that the excess decline is due to the mismanagement including the lack of attention AI National has provided to their residential members.

Jim Amorin has formed this committee to provide solutions to stop their neglect of residential membership. I hope the committee addresses this specific issue and refutes what Bill Garber inaccurately represented to Congress last fall and what Scott DiBiasio asserted in various state legislatures.

AI National is losing membership at an alarming rate. I have been told they spent heavily on their international recruiting and apparently it continues since Scott Robinson just spoke in Serbia. They are also spending on lobbying for alternative standards at a statewide level and in DC. The function of AI National is to create a branding value-add to hold such a designation.

Yes, of course, they are quite different. Why are they different? Because AI National has largely ignored this designation for years relying on decades-early momentum. I believe it can be revived to a limited degree if AI National gets behind it instead of funding speeches in Serbia and Romania.

However, deep down I suspect it is too late — AI National missed their moment. The time for lecturing those who criticize AI National is over because to do so is self-serving. Criticism is the engine that promotes improvement. Whining about critics like me not having the facts is disingenuous.

Focus on the actual problem and help the membership…now. I truly wish the committee well and hope they are able to make effective recommendations to AI National to implement immediately for their residential members. The residential designations for AI members that possess them were hard-earned. The time is now for the committee and roll up their sleeves and get something constructive accomplished for the hard-working residential appraisers in the Appraisal Institute sooner than later.

These efforts are greatly appreciated. When I modified my square footage and number of bedrooms to reflect actual conditions my house is a year-old historic home the value of my home increased 5 fold.

I met former Zillow president Lloyd Frink and their chief economist at the time. Stan Humphries in my office to discuss it. Now that the AVM has been in use for more than a decade, it is ubiquitous. And the fact that it still continues to be presented as rounded to the nearest dollar, infers precision.

As a reminder, Stephen Wagner is part of the inner circle of leadership that is driving this train wreck. He is also the co-chair of the Residential Appraiser Project Team I addressed this previously in REIC on May 16, I plan to take advice from my friend Nathan Pyle when drawing my next floor plan for one of my appraisals. Douglas Elliman published our monthly rental market research on the rental market this week. The market continued to show significant polarization by being soft at the top and strong in the entry-level.

One of the easiest ways to illustrate this phenomenon is comparing doorman and non-doorman median rental prices. It was very odd to see Streeteasy stand by their position given the unethical nature. Finally they acquiesced by creating a navigation path to get to the listing agent.

What I originally loved about Streeteasy before it was acquired by Zillow, was their neutral position in the market. They built a better mousetrap than the individual brokerages to display listing information and as a result, they became ubiquitous.

Now they seem to recognize their lack of competitors and continue to figure out new ways to screw up the site over time. Streeteasy seemed to ascribe to that model by hiding the listing agent. I understand Streeteasy needs to make money, but presenting content and expertise transparently to the consumer is just as important. Politics and personal feelings aside — whatever your views are, Josh Brown, CEO of Ritholtz Wealth Management makes a compelling case as a regular on CNBC Fast Money that the Trump Trade is over.

My extreme distaste for this index aside. Only recently has the index exceeded the peak — that we dug out of the hole we fell into. For example, home prices in NYC metro are largely below prices. You can see how the coastal U.

Trulia looked at income and home value recovery in this interactive chart its extremely compelling. Just walk down a street in the downtown section of your town and take a look at the vacant storefronts.

There are probably a lot of them. There is an interesting shift that is occuring. Consumers have been drawn to new urbanism housing trends, you know, walkable cities. Bank of uganda exchange rates for december 2012 the retail that gives them something to walk to is evaporating in front of them.

Yes, Amazon has played a role, but Lois Weiss, retail journalist maven, provides another nuts and bolts view in her Bisnow column: Retail Is Being Manipulated To Live Another Day. In this Bloomberg Gadfly pieceyou can see that department stores are being crushed.

Lower Manhattan Real Estate Market Overview Q1 — This is a study on the economy in lower Manhattan from the Downtown Alliance. I provide them the residential rent and sales data research from my work on the Manhattan sales and rental reports for Douglas Elliman — conditions continue to improve.

Knight Frank Prime Global Cities Index — Knight Frank is a global real estate services firm that has an alliance with Douglas Elliman. I provide housing data for this particular report in markets that I cover in our Elliman report series. Their graphic designers must be on steroids. Modern White Elephants in Dictatorships: This a fascinating white paper on the proliferation of tall towers worldwide. I discovered this through Citylabwhich does great job discussing the phenomenon and bringing in other insights from the Council on Tall Buildings and Urban Habitat.

But the Citylab article provides the best answer in the pdf forex trading basics. They were ommitting the actual listing agent from properties that appeared on the site and only presented broker contacts adjacent to it that paid for placement.

Simple forex strategy profitable eventually compromised, but I was struck by how hard they defended a practice that was clearly misleading the consumer. Think about Napster and Uber for example.

Now columnist Ken Harney writes pemula forex great piece on the lawsuit and Phil Crawford landed an interview with the plaintiff, Barbara Anderson, who also happens to be a lawyer. My key issue with the Zestimate is how they present it. A Zestimate on a house is presented to the dollar. I watched him play for two decades. I love this guy.

Ok, truth be told, not really, well sort of. Utensils are key…The Frork spelled correctly — I need one of these utensils. Real estate brokerage firms are often afraid to be candid about market conditions with the mantra — it is always a good time to buy — yet that 60 second binary options strategy p no one any good.

MG writes about it in Good Market Reports Are Page Turners For the Savvy Investor. The housing market is heartless and unrelenting like the cyborg in The Terminator as described by the Kyle Reese character: THATS ALL HE DOES. Connect We continue to see more and more high-end sales proving the point that there is demand, but only at the market price.

Sellers are traveling farther to meet the buyers at market levels. That sounds outrageous at the onset, given my ranting about aspirational pricing. However, I took a look at every original sale in the building that had a subsequent sale or 2 or 3 with the last one in the years Those condo sales sold for an average of Perhaps that was what all those blue turtles were dreaming.

Disconnect In a semi-related topic, when you walk the streets of Manhattan, and most towns in the outlying suburbs I have visited over the past year, there are a lot of vacancy signs to see. The massive shift to online provides — namely Amazon — is crushing the retail market. Secondly, there has been a multi-year run of investment property sales with insanely low cap rates because of the shortage of inventory.

Many investors with cash that burned a hole in their pocket are now forced to jack up the retail rents to justify their purchase. The problem is — their asking rents are significantly disconnected from what the market can how many stocks on stock market crashed in 1929. During a recent NYC real estate conference, a sarcastic comment was made as only a New Yorker would say on retail rents:.

The study helps explain the significant changes to the city over the past 15 years: The implication of cash sales in most housing markets, however, infer distress. One of the tragedies of the real estate brokerage industry is that they held on to their Gatekeeper status for too long and it ended up creating opportunities for others. Streeteasy evolved into the defacto Manhattan MLS, but since its acquisition by Zillow a few years ago, it is slowly being Zillowized, by eliminating cool features and inserting annoying features.

Recently there was an uproar about their installation of the Premier Agent service which was done in icici bank forex branch bangalore a way that it did not show the consumer who the listing agent was.

This prompted a great read by The Real Deal New York that laid it all out. However, Streeteasy succumbed to broker outrage and changed the dave ramsey endorses work from home issue buying blue chip stocks singapore gives the consumer a link to the listing agent, so it looks like this crisis has been resolved for now.

Williams was fascinating [Click on the graphic]. My advice to all appraisers …This week I testified in DC as an expert in litigation based on the New York housing market — no appraisal was done for this assignment and no details of the case can be shared, but I crushed it. I think every appraiser needs to testify at least once in their career — hopefully early on.

You see the appraisal process much differently when a lawyer is asking you to explain yourself. There is a clarity that washes over after the first time. Throw yourself into it.

Through repetition, you deaden your nerve endings, and you new york stock exchange closing bell schedule immersed in a lucrative appraisal discipline. Personally, I love it. The other thing you need to do is read about the profession all the time.

Our industry has been beaten down for years, but I think a lot of that has to do with not being aware of the upcoming regulatory changes and the activities of industry institutions since those such as AI National and AMCs count on your complacency.

Emini support and resistance day trading futures of the best ways to hone your appraisal craft is to read about problem-solving from your peers. Not about byzantine rules, but how to problem solve each unique valuation situation you face. Sign up for their weekly emails in the links at the bottom of these Housing Notes.

I learn a lot from them and you will too. The log-in for members on the AI website was down from Wednesday until a few minutes ago Friday morning. Everyone has technology issues. Only estimate, not appraisal. I met one of the founders of Zillow at a party the day before they launched more than a decade ago. The voyeurism can be fun, but when the results are zeroed down to the dollar, it can become an accepted source of value by the consumer masses.

Now someone has taken issue with that and are suing Zillow. Phil Crawford has an interview with the plaintiff on the upcoming free Wednesday edition of Voice of Appraisal. A while back, the WSJ interviewed me because of my Zestimate I have a year-old historic homewas 5x what it was optimistically worth. If I was uninformed about my market, I suspect it would take me years to resolve my anchoring to the inflated number. Send him an email dtowne fidalgo. I found his posting about this on The National Appraisal Coalition Facebook page.

Re-send and re-post this message to your appraiser buddies and other bloggers, web sites, trade journals, etc. If Mark sees this message, please keep us informed about the process to get accepted. In other words, banks and mortgage company hire this AMC because they place more value in administration, rather than the expert taking the risk and coming up with a professional opinion of value to make a lending decision.

This incorrect emphasis is somehow acceptable to the banking system. I remember when HVCC went into effect on May 1, eventually sunsetted into Dodd-Frank and the justification mantra for banks and AMCs was a combination of cost-savings and a firewall. But it looks like. Translation of above investor comments in red: Coester is simply saying: I find this makes the review process of this AMC highly suspect.

The fact that this fee arrangement is typical is absolutely surreal and unacceptable. Regulators and banks don;t really appreciate how bad the appraisal management process really is. Here are some posts over at my forum euro rate as on 31st march 2016 in india as the Real Estate Industrial Complex where I have been chronicling the unfortunate anti-membership activities of AI National.

Back on April 10, I wrote a post here that essentially pronounced the residential committee that Jim Amorin proposed was DOA since it had been months since there was any feedback shared. I received a few emails today that shared the month old email announcing the committee. Here is the original header and the specific section of the letter that covers the committee.

Sadly, I believe that this effort is a waste of time. I hope I am wrong. It is a noble attempt by AI members to repair the diluted SRA designation brand that so many worked so hard to obtain. And then expecting those same leaders to embrace any recommendations from such a committee? Let us remember that the idea to form this committee was by leadership that ignored residential forex bullish hammer during this critical decade.

AI National leadership already knows what to do about the residential membership neglect and the dilution of the SRA brand.

The top leadership is not a bunch of children, and there is no magic or complex research needed to solve the residential appraiser void at AI National. It would take AI President Jim Amorin and his handful of executive peers 5 minutes or less to include residential within the organizational culture and start moving forward in a meaningful way. I believe it is simply too late and the residential profession has already passed them by.

I just finished my four-week quarterly gauntlet of 23 market reports covering 32 housing markets across the U.

In fact next week I am traveling to D. My death-warmed-over feeling will soon be replaced with numbers. I never grow tired of seeing the moving parts of trader joes organic vegetable broth reviews many different housing markets and how they compare and contrast. Why the Brooklyn-Queens Border Is Full of Dead People.

The Bloomberg coverage on our Hamptons report was the 5th most read on the Bloomberg terminals worldwide. And of course, stock market for dummies india came with a chart, and charts simply cheat death, or specifically, make me feel alive.

Long Island was a classic example of U. Heavy sales, record low inventory and rising prices. While North Fork was noticeably slower but with an unusual burst of very high-end sales. There was clearly an uptick in sales but also a little more life at the top of the market. LA remains one of the tighter markets we cover after Brooklyn. This quarter forex gump film tried something new in our analytics for LA.

We sussed out pocket listings. As I explained in my blog how do i get estate cash in hidden chronicles. We matched public record closings with properties listed on the MLS. Notice how the occurrence of these listings is higher at the top of the market? Entrenched brokers with a lot of local experience are the ones who foster relationships with these high-end owners. Across the country there would be more home sales if there was more inventory with the possible exception of the high-end market.

We observed this phenomenon in markets like Long IslandNew York and Los AngelesCalifornia where the the trend in pending sales was negative because the trend in inventory was negative as well. There are many reasons for this:. There is a great weekly column in The Real Deal magazine called The Long View by Konrad Putzier.

This week he delved into concessions with: Sales Incentives Despite their popularity, I never understood the use of incentives to bring in more buyers. Get a Ferrari if you buy a condo in our building.

Buyers are in the market for a condo, not a car. They are more interested in applying the cost of the item from the purchase price.

I see it download stock data to excel yahoo a marketing tool when a buyer is on the fence, rather than to draw in new buyers. Then why does this keep happening? Because when the pressure rises as sales fall, the idea of just doing something flashy, anything, to get the project selling again. I see it as more of the grieving process a developer has to go through to align with market value.

Landlord Incentives With landlord concessions, I was more appreciative of the idea that when a landlord offers very large concessions, they stop working for both the landlord and the tenant. The tenant will begin to assume that the rent will spike at the end of the lease and they will have to move out. The landlord will realize that they will see a falling rate of lease renewals. Remember all those talking heads and pundits describing the U.

It was prolific since the housing bubble burst. Well household formation by owners is outpacing renters for the first time since There was an interesting piece on Manhattan neighborhood names in Crains. Who decides should i buy blackberry stock a neighborhood is called and 777 top binary option signals it starts and ends?

An ongoing brouhaha over what to call a section of Harlem is the latest battle in a long-running war over neighborhood naming rights. This debate appears every years it seems. Detracters view it as an insult to existing residents.

Neighborhood names have changed and evolved for hundreds of years. Neighborhood boundaries expand and contract. Neighborhoods are always in a state of change, whether it is the retail, the housing mix, jobs, etc. It is not a legal entity like a country, state, county, borough or city.

Apparently, there was a lot of beer consumed in the 19th century. No Vanilla european put option Adams Cherry Wheat back then either. Now with the new economic data that GDP only grew at a 0. This extended period of ultralow interest rates no longer benefits the average U. Low rates initially provided middle-class households with relief both by lowering monthly mortgage payments and supporting a recovery in home values.

However, the investments of these same families have suffered. Indeed, many middle-class families, frightened by the precipitous market decline ofresponded by pulling out of the market.

Crucially, without stocks and the growth in value and dividends they can provide, most households must rely on interest from their investments to save for college, a down payment on a home or to prepare for and navigate retirement. It is here that they have felt the sting of near-zero interest rates. Interest income for households has declined sharply in the aggregate. This week we talk about a bombshell lawsuit that all of us will be talking about for a while. Coester Chronicles Continued Do you like to read John Grisham books?

I have a story that is much better. It is about a residential fee appraiser in Georgia who filed suit against what the appraisal industry sees as the most notorious AMCs out there and its owner.

The appraiser provides compelling tangible evidence with his claim that his email was hacked by the AMC. The lawsuit was filed in United States District of Court for the District of Maryland.

Here is the complaint that was filed. This morning Phil Crawford over at Voice of Appraisal gives a good overview of the lawsuit. One of the legal concepts most interesting to me in the complaint was trespassing, especially when an email is sitting on a Google server somewhere in the ether. If Coester loses, I would imagine there would be a massive settlement.

After all their legal troubles, the fact they are still around — shows how much money has been taken from the hides of appraisers. UPDATE later in the same day: Something I forgot to mention when I originally posted this.

A big part of that love was born from the fact it drove my roommates crazy as devotees of the glam rock genre, i. Boston, Styx, REO Speedwagon, Journey, etc. Sadly they missed out on the debate of important things like where the band name came from — was it inspired by honky tonk jazz pianist Floyd Cramer or blues guitarists Pink Anderson and Floyd Council?

Or could Queen write Several Species of Small Furry Animals Gathered Together quotes about earning your own money a Cave and Grooving with a Pict?

I find much of their early stuff unbearable to listen to now, but thankfully Pink Floyd still has a lot of great music in their catalog. This is some sort of analogy about how I have always enjoyed taking the other path and annoying others by not following the herd. Clearing and settlement process in indian stock market ppt Pink Floyd gets a species of shrimp named after it.

But enough of the stuff you came to Housing Notes to read about. Douglas Elliman Real Estatethe fourth largest real estate firm in the U. Apparently Wall Street loves a good Greenwich, CT housing story as the Bloomberg article: Greenwich Homes Get Cheaper and Finally Start Selling Again was the most emailed on the Bloomberg terminals worldwide yesterday.

Fairfield County Sales 1Q Greenwich Sales 1Q And the article had a chart that tells the story about the uptick there after a weaker I r-mesa 5 trading system in occasionally because he brings greater transparency to easy xp binary options review housing market.

His oratory is snarky, even troll-like, as many good bloggers are, but it works and has earned him a rabid following. And the reporter duly updated the story. Transparency in action is a good thing. The quote is representative of the primary reason why an MLS should never be the source of objective analysis on a housing market.

An MLS is comprised of a board, usually comprised of company owners, and software developers, usually outsourced. The perception of the MLS as a wealth of real estate insight is simply misplaced. You can see it here:. This is gobbly-gook word soup. This reads like a horoscope — while it makes sense and tells you things, it has nothing to do with the market specifically right now. The national election held back demand throughout and after the election, there was a release of pent-up demand in the first quarter of We are seeing that seller sentiment is coming more trade on binary options strategy line with market conditions after being very detached from the market for several years.

This is happening throughout the region. The town is currently grappling with their image — they are proposing the hiring of a public relations company to re-brand the town. Beijing bans property websites from giving Feng Shui advice to help cool its housing market [ The Real Deal NY ]. In addition to Greenwich and Fairfield County, Connecticut, Douglas Elliman Real Estate published a slew of our market research in South Florida. The coverage of the report releases are shared in the links at the bottom of Housing Notes.

Across the 8 different reports how to make money with 525 blacksmithing mop 5.3 are pushing out tomorrow, we saw mixed results, but more markets saw an increase in sales activity of their respective overall markets. More markets showed gains in median sales price as well.

While there was more volatility in luxury price trends with a shift towards smaller luxury units. The market is clearly weaker at the top than it is everywhere else but the luxury results across all the regions could be described as performing better pet shop boys opportunities lets make lots of money they were in previous quarters based on sales and price trends.

Here are the South Florida reports that came out:. We continue to read about high-end sales and large discounts. This is a good thing in a market healing process. Whenever you read of a very large sale, take a close look at the size of the discount. Are landlords creating another problem? There is a great read on this in the Real Deal. I shared this chart 2 weeks ago but I love how it illustrates how high the share of concessions has become.

When a market grows soft, they may start providing incentives to entice buyers such as decorating allowances, paying mansion and transfer taxes, etc.

Hidden Chronicles Walkthrough - Gamezebo

All of this is done to protect the price published in public record. They worry about cannibalizing future sales. But when the market has corrected far more, then incentives are a waste of time. The Appraisal Institute can rest easy this week. This is good news for both organizations who are likely consolidating resources and filling a void left by the Appraisal Institute who has lost the confidence of their membership and continues to work against them at the state and national level — pushing for alternative standards in order as a pathway out of irrelevance.

This one of the reasons the state coalitions sprung robot forex future professional download in more than half of the states.

Monopolies never seem to last forever. This has been a weird week. Throw in a combination of holiday school vacations and religious holidays that made my commute into New York City from Connecticut, well, reasonable. I also think this week also marks the point in the year where we find out if the post-election bump in housing will continue.

So far, the markets I cover across the U. While we are seeing more sales at the higher end of the market that should not be confused with improving conditions in the typical sense. Many of the high end deals that have occured are because the seller traveled a longer way to meet the buyer on price. We published 7 Elliman Reports this week, part of an expanding series of market research for Douglas Elliman Real Estate that I began writing 23 years ago.

Before we get into the top level snapshots of all the reports, I wanted to speak about the Brooklyn sales market. During the development housing boom of the rs make money thieving 5 years, the optics on the Brooklyn housing market has been one of an outlier.

After all, even with all the tall towers rising in Manhattan, Brooklyn was the first NYC borough to exceed the pre-Lehman high after the financial crisis. But in many ways, Manhattan is the outlier and appears to be several years ahead of the other NYC boroughs. The description of Brooklyn and Queens sales markets are one of rising sales, falling inventory and rising prices at or close to record levels.

As an appraiser I know that the more adjustments that are applied to a data point, the less reliable it is. Our Brooklyn sales market results got a lot of interest, earning the fourth most read spot on the Bloomberg Terminals exchange foreign forex forex market street trading wide, but trailed the woes of the London housing market.

Brooklyn Sales 1Q The Brooklyn housing market was characterized by records for the overall sales price trend indicators, heavy sales volume and falling inventory.

Overall prices were skewed higher by more new development closings that averaged twice the size of the prior year quarter. Borough wide median sales price jumped This was the third consecutive stock market day trading simulator record set for this metric. Queens Sales 1Q The Queens housing market has been performing much like its adjacent Brooklyn neighbor. Borough wide, the median sales price increased Average sales price followed the same pattern, rising Luxury median sales price….

MANHATTAN Despite a modest rise in net effective median rent, the use of concessions by Manhattan landlords more than doubled to the second highest market share on record.

Median net effective rental price edged up 1. Landlord concessions represented Over the past several months growing use of concessions…. BROOKLYN Median face rent moved 2. The market share of studio and 1-bedroom new leases jumped 5. At the same time, the median rental price of a studio jumped 9.

After considering the Landlord concession market share had more than doubled…. A significant how to get free farm cash on farmville 2 facebook of the demand came from city renters and trade-up buyers priced out of their respective markets. The number of sales increased Single-family sales represented Co-op sales represented Co-op sales volume was robust with….

PUTNAM Despite the year over year decline in sales volume, the number of sales in Putnam County was the second highest first quarter total of the past 12 years. There were sales, down 3. Listing inventory fell With high sales volume and much less supply, the pace of the market moved faster. The absorption rate, the number of months it would take to sell all inventory at the current rate of sales was 7.

DUTCHESS Sales volume in Dutchess County continued to rise, resulting in the most first quarter sales in 21 years. The heavy volume overpowered inventory from keeping up with demand.

There were sales in the first quarter, up At the same time listing inventory dropped As a result, the pace of the market moved faster. The absorption rate, the number of months to sell all listing inventory at the current rate of sales, was 7. Riverdale Sales 1Q RIVERDALE Sales declined in the Riverdale section of the Bronx, including Fieldston, Hudson Hill, North Riverdale and Spuyten Duyvil, limited by available inventory.

The shortage of sales was more pronounced at the upper end of the market skewing price trend indicators lower. The decline in average sales price was more pronounced due to less activity at the top of the market, declining By property type as compared to the prior year quarter: Listing inventory declined All the things that actually drive the housing market: I was unable to attend but got the download from others that were there. My theory on why AI National has gone rogue in recent years is making more and more sense if you assume they realize they are going under in the near term and want to replace the ASC to receive the national registry appraisal fee revenue.

Unfortunately Scott spoke for about 35 minutes without being stopped by the moderator who was a last minute replacement. David and Jim stuck to their 10 minutes. It was good to see the state regulators express such outrage at AI National efforts to confuse the public, Congress and financial institutions.

From the FDIC guide:. Four common exemptions to the appraisal requirements: See Financial Institution Letterissued March 18, I said that if they just had the appraiser remeasure they would remain biased low and not change the comps. Well, the appraiser remeasured the house and found about half of the additional square footage they missed the fist time but used nearly all the same data.

They originally missed square feet. The bank defended them because they are a good appraisal firm. I think our industry has learned that it is better in the long run not to admit our mistakes because we will be punished for the change. It is better to stick to our guns and not change anything. Incidentally, we just applied for a homequity line and the appraiser measured the house in line with the previous half dozen appraisers on prior refis, insurance and the purchase.

I remain pretty frustrated with the appraiser who happens to be terrible at measuring, but otherwise good at valuation. This makes sense as they have been bypassing the local chapter leadership to insert text in upcoming legislation. Again, a significant trust issue between AI leadership and its membership. My college roommate and best man at my wedding organized a March Madness bracket after we graduated college 35 years ago damn!

So this oversized Housing Note is a combination of catch-up and new stuff. Some of this you may have seen in my twitter feed as a way to get it the information out there reasonably on time. I hate to brag, but our data appeared in a recent issue of FarmLife magazine.

A little over 5 years ago I wrote a blog post looking at Manhattan real estate values by decade for the century. It was a fun piece but I had no idea this one post would average about 1, views for more than 5 years. It continues to peak interest to this day — as a launch point for a recent WSJ article and another article by a French publication to come out next week. I do know that Manhattan real estate is a spectator sport like no other market.

Real estate company Douglas Elliman published our research in the Elliman Report: Manhattan Sales 1Q17part of a report series I have authored for 23 years. We also wrote a submarket report on Northern Manhattan.

One of the topics of discussion has been the surge in the stock market since the election. We also see this point being made in the housing market. Real estate agent feedback speaks to pent-up demand accumulated before the election that was released after the election. Manhattan resales jumped 7. We also continued to see the frequency of bidding wars drop to Bloomberg charted our numbers. There was a lot of interest in this particular report.

There were a lot of great articles on our market report shared in the links below. I did a Bloomberg Radio segment on the report after its release with Denise Pelligrini — always a pleasure.

Also did a fun Bloomberg Radio segment at And speaking of food, there was an interesting article that considered housing price trends and the downfall of Le Cirqueonce a five-star restaurant. And we have a bunch of updated charts on our site — here a few. I know they need a revenue stream but misleading their users of the identity of the listing agent is not the way to do it. The listing agent needs to be identified.

One of the reasons StreetEasy has been so popular within the agent community is that the listings also provide an important stream of referrals. REBNY did go to Albany and protest but I doubt if that will effect change.

At the request of the New York TimesI crunched numbers that they turned into a beautiful infographic. Here was my prior commuter analysis in Fairfield County. And with the extension of days on market, buyers were perfectly willing to wait.

The current price represents an That shows you how much represented a high-end price boom not grounded in rational thinking. And now 3 years later, sellers are finally rethinking their understanding of value. Engage The New Miami: I had a terrific conversation with Howard Lorber Chairman of Douglas Elliman Real Estate — 4th largest U. RE firmNeisen Kasdin Former Miami mayor, Managing Principal, Akerman Miami office and Michael Stern Chairman, JDS, New York and Miami developer.

Jim Murrett jmurrett appraisalinstitute. To a passer-by, this explanation sounds very official and Jim is certainly brimming with confidence. Scott DiBiaso, the pit bull on this issue at the state level, in a separate email chain had the same confidence:.

Their responses are poorly reasoned and stunningly damaging to appraisers and the appraisal industry — particularly residential appraisers because it assumes that the public is just as informed as the appraisers and the AI National Board. As Scott indicated, AI National merely wants to give appraisers more choices for business opportunities, and if they want to do evaluations, they will have the right to do them rather than have non-appraisers do them.

When an appraiser comes up with a value, it is an appraisal. It is not a box. It is not a fox. It is not a dog. It is not a log. It is an appraisal. That is what an appraisal is to the consumer. This applies to real estate, art, personal property, etc. The consumer HAS NO IDEA how either value in each scenario was estimated but one thing they do know — the number is a number and the person giving the number is an appraiser. This situation is a direct violation of the public trust.

AI National is making the case that the consumer understands the nuance. When I took my state license exam back inI was in the room with pool cleaners, dog groomers and barbers to take various licensing exams.

They are standing in the green surgical gown speaking to the patient beforehand. The patient has financial troubles, and the surgeon had previously offered to do the procedure cheaper — so the surgeon flips the switch and is no longer a doctor.

He botches the surgery, and the patient sues the doctor because as far as they are concerned, they went through with the surgery because they knew that the doctor went to medical school and knew how to do the surgery. It was the same person. The public cannot distinguish between the two.

AI National is stunningly wrong here yet they represent appraisers. Appraisers have a lot more training about valuation than someone walking in off the street doing evaluations.

It is clear that AI National leadership has little understanding of the residential appraisal industry and is wholly focused on the commercial world. Is AI National this stupid or are they lying aka falsehood because some other deal lays in waiting with REVAA, FNC or elsewhere. As I scramble to catch up after a few weeks off, I want to make sure to include this terrific article by columnist Kenneth R.

Harney, a syndicated columnist who is one of the feew national journalists to take interest in the appraisal profession. Subscribe to premium access and support someone who is bringing transparency to our industry and is a practicing appraiser. Here is the latest episode.

Note the episode comment on YouTube: This nightmare is only as good as Trump travel ban. How stupid would you have to be to only talk to interns and never the doctor. Hey doc I came in for a tonsillectomy and you removed my kidney. Yeah, I am John Smith but I live on Main not First. Appraisal Institute Media Coverage Seen by Nearly Million Between July and December. My concern over the credibility of stats like this are the following issues.

For mortgage work, the SRA brand is no longer a significant differentiator, and it is far less of a differentiator than it was a decade ago for non-mortgage work. This is a common refrain from members I interact with. As I have mentioned before, a number of MAIs I have spoken with say their designation is next, likely fading away in less than a decade.

That blame falls squarely on AI National for failing to adequately brand the SRA and MAI designations. It also does and did a disservice to all current and newly former members who dutifully paid dues for years and worked hard to earn their designations.

So I thought about the million mega number and the trust issue that AI membership has with AI National leadership. But again, there is a deep distrust issue with membership and AI National. Based on past and recent actions, it seems highly unlikely that membership will ever be told. Guide Note 13 Performing Evaluations of Real Property Collateral for Lenders.

I completely mislead you last week, a byproduct of my own lack of time management skills. To illustrate, here is a story about a person obsessed with abandoned couches. March 30, — Bloomberg Radio: Joined Tom Keene and David Gura of Bloomberg Surveillance live from the Pierre Hotel in Manhattan to talk housing.

April 6, — Miami Herald: Real estate for second-home owners and investors panelists include Howard Lorber, chairman, Douglas Elliman; Michael Stern, chairman JDS development; Neisen Kasdin, Miami office managing partner, Akerman.

Moderated by Jonathan Miller, president and CEO, Miller Samuel real estate consultancy. May 3, — REFA: Miller of Miller Samuel Inc. I apologize to all my appraiser colleagues for my lack of content over the past 2 weeks. In contrast, there is a lot of insanity going on with AI National at the state level. I plan to get off the couch next week so please rest up. If you haven't already, sign up for 'Housing Notes' to receive weekly insights and research.

Jonathan Miller is President and CEO of Miller Samuel Inc. He is a state-certified real estate appraiser in New York and Connecticut, performing court testimony as an expert witness in various local, state and federal courts. He holds the Counselors of Real Estate CRE and Certified Relocation Professional CRP designations. You'll be able to choose from an array of robust housing metrics compiled using research developed during the preparation of our market report series.

Expanded significantly from prior offerings, use this resource to build charts and custom data tables or leverage your own information for more powerful research and presentations. In the meantime, here is a small sample of the aggregated data we will provide. Fortunately we found one. His name is Jonathan Miller. One of the top five U. One of the top 25 most influential U. One of the best finance people on Twitter. Completely Keanu Reeves-free real estate economics, not for beginners.

Can dodge bullets in slow-mo. Thank the Flying Spaghetti Monster he's on our side. Best online real estate expert. I spoke to appraiser Jonathan Miller 3 years ago. He's the guy with 'boots on the ground' when it comes to real estate.

Curbed NY Curbed DC Curbed Miami Curbed Hamptons Curbed LA Curbed Ski Curbed 3CW Full Chart Archive. New York Times experiment ''. The Manhattan Market by Zip Code on. Favorite "How to Value" Posts Matrix Blog Roll. But when a penthouse has many open houses and sits on the market for more than a year, it seems reasonable to wonder about pricing. Samantha Sharf at… Read More. For commercial valuation services, please contact our affiliate:. June 16, Heroes of The Housing Tornado: On Wednesday, the technology giant announced its efforts to alleviate the ever-tight and ever-expensive housing market of Silicon Valley through an investment in modular housing.

The industry averaged just k completions from For that price in Hong Kong, you can buy a slab of concrete, roughly 17 feet long and 11 feet wide, to leave your luxury car. From my Matrix post … Not too long ago there was a webinar hosted by Housingwire that included some Powerpoint slides by one of the panelists, Matt Simmons. And The Survey Says! A Brilliant Idea If you need something rock solid in your life particularly on Friday afternoons and someone forwarded this to you, or you think you already subscribedsign up here for these weekly Housing Notes.

See you next week. Most Of Them [Zero Hedge] Bond Traders Detect Fed Error [Bloomberg] The Mall of the Future Will Have No Stores [WSJ] Global House Price Index Gains Momentum [Knight Frank] 5 Root Causes for U. What Market Supports [Miller Samuel] From Industrial Wasteland to Hot Luxury Market in New York City [realtor.

The Painting Behind the Piano [Magnusson Group] FTC's First Test Of Supreme Court's North Carolina Dental Precedent In New Case Against Real Estate Appraisal Board — [Mondaq] Extra Curricular Reads Adam West Dead: The May Elliman Report Was Published Douglas Elliman just published my research on the New York City market, namely the Manhattan, Brooklyn and northwest Queens rental market.

Here are the matrix tables for each of the 3 markets: And some extracurricular charting: Ok, one more thing on rentals, really… With the heavy use of concessions, landlords are in danger of attracking too many renters that can only afford the rent if they are provided with concessions.

Jobs and Homeownership The U. It looks like salad days for engineers. Squatters of the Lower East Side When my wife and I moved to Manhattan in from the midwest, it was a little dicey.

Squatters of the Lower East Side [click to play] The Global Glut of Super Luxury The FT takes a great broadsweeping of the aftermath of the global super luxury development boom. The luxury construction frenzy has produced too many buildings, and political factors have turned against the sector.

China has attempted to clamp down on money flowing out of the country, while low oil prices and sanctions have curbed sales to Russian buyers.

Cities around the world are imposing new taxes on overseas property buyers, and there is increased scrutiny of money laundering through high-end property. The mayors of London and New York have pointed to gleaming residential towers as symbols of inequality amid chronic shortages of affordable housing. Upcoming Speaking Events June 13, — Real Estate Board of New York: What If We Could Use Neural Technology To Block People In Real Life [Digg] Roasteries and refineries: The history of sugar and coffee in NYC [6sqft] Unsealed 75 years after the Battle of Midway: Are 19 Bathrooms Enough?

Here are a few summaries for the banks whose regions overlap those of our Elliman report series: Freddie Mac Tells Us That Rate Growth Seems To Be No More Oh, and no matter how many time Fed FOMC members speak in public about strong economic growth and future multiple rate increases, mortgage rates are sliding. Mortgage Interest Deduction Lifts Housing Prices There was an interesting article in The Real Deal Magazine column: According to a well known study by Richard Green, Patric Hendershott and Dennis CapozzaU.

The logic is simple. The deduction makes it cheaper for Americans to take out mortgages, which means they can afford to pay more for homes, which artificially inflates demand, which in turn drives up home prices. We changed from a country in which landowners had the relatively unfettered freedom to add density to a country in which veto rights over new projects are shared by a dizzying array of abutters and stakeholders.

Consequently, we now build far less in the most successful, best-educated parts of the country, and housing prices in these areas are far higher than construction costs or prices elsewhere. Off Topic This week I am sitting in my D. I implore you to consume both riveting interviews: Marc Andreessen, Venture Capitalist at A16Z [ link ] TED — Elon Musk: Apple, known for iPhones and MacBook Pros and their new saucer-like circle headquarters building… And in the process, patented a better pizza boxalthough technically it is no longer a square box circle.

New Single Family Home Sizes Are Getting Smaller I thought this was a pretty interesting point made by NAHB on new home sizes: Typical new home size falls prior to and during a recession as home buyers tighten budgets, and then sizes rise as high-end homebuyers, who face fewer credit constraints, return to the housing market in relatively greater proportions.

She is now representing an area homebuilder who looks to make their case go to class-action: The lawsuit seeks an injunction against Zillow, saying that the Patels and the company have never requested or authorized Zillow to gather data about their properties or to publish it. More on the Retail Apocolypse: While I Have Style, The Celebrity Premium Is A Myth Humblebrag: People might be increasingly reluctant to spend today because they have vague fears about their long-term employability — fears that may not be uppermost in their minds when they answer consumer confidence surveys.

If that is the case, they might increasingly need stimulus in the form of low interest rates to keep them spending. I Wonder How Wealthy Home Owners Price Their Homes? Have a terrific Memorial Day Weekend. A Prize Is Offered for Improving Them [NY Times] Zillow in Court Again Over Zestimate Accuracy and Consumer Interpretation [CandysDirt.

NYC Real-Estate Market Is Imploding [Zero Hedge] Miami, New York Log Highest Rates of Suspicious Luxury Real Estate Buys [Mansion Global] Retired artist had no idea he was 'mysterious' tenant in viral SC property listing [WIS TV] My New Content, Research and Mentions The micro apartments are coming to Miami. Are you ready for tiny living? Eleven Madison Park and Uber Finally!

Are Coming to the East End [NY Times] Appraisal Related Reads I Messed Up Really! The role of State and National Appraisal Groups [Appraiser eLearning] AVMs to Finally Replace Appraisers? Class-Action Suit Against Zillow's Zestimates [Appraisersblogs] Is it the appraiser's job to support value? May 19, Sgt. One could argue that this seminal album does not contain many deep tracks.

NYC metro area NY Fed Business Leaders Survey [Sgt. A Listing Description for the Ages [With a Little Help from My Friends] There was a listing with this description on Zillow. This listing says in full: Borrowers Credit Scores are insane. There is still no consensus on why the last housing boom and bust happened. That is troubling, because that violent housing cycle helped to produce the Great Recession and financial crisis of to We need to understand it all if we are going to be able to avoid ordeals like that in the future.

TRD analysis Mile High Buildings? Premium for private park access [Within You Without You] Some Gramercy Park area residents in Manhattan have access to a beautiful 2 acre private park. Second Avenue Subway Access Problems [Lovely Rita] Sprinklers accidentally turned on and damaged three escalators at the 86th Street station on the new Second Avenue subway line. No, not one of these. Forward-Looking Sentiment Cooling Off [Sgt. From the Desk of Dave Towne: Your Appraisal Signature For excellent periodic insights, send appraiser Dave Towne a request to be added to his email distribution list: This verbiage came out today: The real estate technology firm known as Zillow uses an algorithmic propriety formula to compute this value.

It is important to note that Zillow makes the following statement on their website about this product: It is not an appraisal. The Zestimate is calculated from public and user-submitted data, taking into account special features, location, and market conditions. The Outside World Continues to Fail to Understand Our Role in the Homebuying Process From the Denver Post: Part of that could reflect offers from buyers that are going above what appraisers are willing to support.

Kenneth Harney, syndicated columnist writes: The following feedback was just shared with me by an attendee. The Regional 8 meeting was on Saturday. That is generally composed of Central Texas, El Paso, North Texas, South Texas, Houston and Austin. In short nothing has changed with respect to AI. Beta testing will begin in the next few months with some chapters for the new policy and most larger chapters are not. So if some chapters need the AI Mothering FINE. But those of us who do not what AI to provide this mothering want an opt in opt out provision.

I am totally ashamed of our leadership and embarrassed at what this is doing to our reputation nationwide. New York, northern New Jersey, and southwestern Connecticut [NY Fed] Labor Shortage Squeezes Builders [WSJ] Millionaire to Millennials: The Key to Higher Home-Sale Prices [Mansion Global] Tips for first-time homebuyers in NYC: Investors are placing huge bets on the borough — but the numbers may not pencil out [The Real Deal NY] Appraisal Related Reads How does a residential appraiser obtain a contract with an appraisal management company AMC?

Top 6 reasons real estate appraisers should have a blog [Birmingham Appraisal Blog] 5 things to remember about lofty list prices [Sacramento Appraisal Blog] 5 common questions about property value appraisals in Montgomery County [Community Impact Newspaper] Analyzing and Reporting Market Trends in Residential Appraisals [Appraisal Buzz] Extra Curricular Reads Sgt.

Pepper Turns 50 [FYI Music News] If America Were a Company, Would You Keep Trump as CEO? May 12, The Danger of Drawing Housing Markets With Avocados I plan to take advice from my friend Nathan Pyle when drawing my next floor plan for one of my appraisals.

Prices are booming… … but so are avocado-related trips to the emergency room. Now back to drawing the market. Here are some of my favorite Manhattan rental charts we created this month. It has nothing to do with the playing field. It has everything to do with who has the most money to pay to be in front of the consumer. Ok, on to the useful stuff. MG writes about it in Good Market Reports Are Page Turners For the Savvy Investor The housing market is heartless and unrelenting like the cyborg in The Terminator as described by the Kyle Reese character: