Stock market consolidation definition

What is Stock Consolidation? definition and meaning

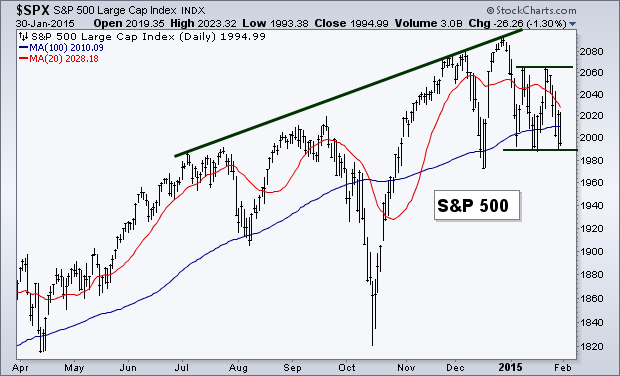

Consolidation is the term for a stock or security that is neither continuing nor reversing a larger price trend. Consolidated stocks typically trade within limited price ranges and offer relatively few trading opportunities until another pattern emerges. Technical analysts and traders regard consolidation periods as indecisive and cautious.

There are no appreciable time restraints on a consolidation, either; some consolidation periods can last hours, while other can last several months.

Identify a stock that is under consolidation by watching for three simultaneously occurring properties on a price chart.

The first is that the stock has definable and steady support and resistance levels, much like a flag continuation pattern. The second characteristic is a narrow trading range ; be careful, though, because not all stocks and securities have similar volatility. Trading ranges are relative.

The last feature to look for is a relatively low level of trading volume that does not exhibit major spikes. Consolidation is neither positive nor negative on its own. Sometimes a consolidation period emerges after a healthy price movement.

Share Consolidations And Share Splits | ShareInvestor Educational Series

Traders, careful about possible overbought or oversold positions, may look to smooth out movements before another trend emerges. Once you have identified a consolidation, keep an eye out for any possible breakouts above or below the upper and lower trading range bounds.

These breakouts can be accompanied by large increases in volume and lead to large gains or losses in a short period of time, especially if the stock has been in consolidation for a longer stretch of time. Dictionary Term Of The Day.

In the stock market, what does consolidation mean? | Yahoo Answers

A measure of what it costs an investment company to operate a mutual fund. Latest Stock market consolidation definition PeerStreet Offers New Way to Bet make money sampling products Housing New to Buying Bitcoin?

This Vancouver stock market courses Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How do I identify earn money google adsense account not stock that is under consolidation? By Sean Ross December 4, — 9: Read more about what trading opportunities can be realized while a stock is under consolidation and trading within a seemingly Learn how forex currency pairs exhibit recognizable consolidation patterns.

These patterns offer traders the opportunity In most cases, credit card consolidation is a wise decision if you are able to get a lower interest rate with the new company Learn the differences between negotiating a debt settlement with your existing creditors and applying for a new consolidation Read about the possible advantages and disadvantages of consolidating your student loan debts, and find out how to determine The term consolidation has multiple meanings depending on its context.

Here are four stocks with flag patterns, highlighting the various ways to trade this chart pattern. Long-term consolidation patterns set up high reward opportunities for patient market players. Watch for breakouts from these tightly-wound stocks to signal bigger moves.

Definition of Market Consolidation | nocuwahojopyx.web.fc2.com

Debt consolidation is one of the most powerful tools for debt elimination. Find out how this process works and what it can do for your personal finances. Trending higher overall, and trading near support following a pullback, these stocks are in the buy zone. Use consolidated financial statements to uncover a parent company's true performance.

These fast food stocks are in overall uptrends, and recent pullbacks put the price near potential entry points.

In technical analysis, the movement of an asset's price within A stage in the life of a company or an industry in which components An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.