Graded vesting stock options ifrs

IFRS 2 — Share-based Payment

Share-based employee compensation awards are classified as either equity instruments or liability instruments. The measurement date for estimating the fair value of equity instruments is the grant date; the measurement date for liability instruments is the settlement date. Different rules also apply to public vs. Restricted stock and stock units are popular with public companies; stock options continue to be the most popular choice for private companies.

When weighing the pros and cons of various compensation awards, CPAs should help companies consider factors such as the potential dilutive effect on earnings per share, the accounting costs of competing alternatives and the tax implications to both employer and employee.

Companies should also consider vesting criteria, exercise period and overall employee eligibility. LeaheyCPA, is an assistant professor of accounting at the University of Texas at El Paso. Her e-mail address is aleahey utep. His e-mail address is rzimmer utep. Before FASB issued Statement no. Companies typically used the alternative intrinsic value method to value those options; with a grant-date intrinsic value of zero, the company recognized no compensation expense.

Since the release of Statement no. This article summarizes the valuation requirements of Statement no. Equity instruments require a company to issue equity shares to employees in a share-based payment arrangement. Common types of equity instruments include equity shares, share-settled stock units also known as phantom stockstock options and similar share-settled stock appreciation rights share-settled SARs.

Liability instruments generally require the entity to use cash or noncash assets to settle a share-based payment arrangement. The common liability instruments are cash-settled stock units and cash-settled SARs. Although the best estimate of fair value for both types of awards is the observable price of identical or similar instruments in an active market, such information is generally not available.

Consequently, companies need to estimate fair value. Here are some guidelines CPAs can use to value employee compensation awards commonly granted by the two types of companies. EQUITY SHARES OR SHARE-SETTLED STOCK UNITS Public entity. The fair value of equity shares or share-settled stock units awarded to public company employees is the grant-date market price. Nonvested shares are valued as if they were vested and issued on the grant date.

For shares with a restriction on transferability after vesting, CPAs should include a discount reflecting that restriction in the estimated fair value. Due to the absence of an observable external market price for its shares, a nonpublic entity may use its internal price or a private transaction price if such information provides a reasonable basis to measure the grant-date fair value.

Otherwise, CPAs can determine fair value using an appropriate valuation method. The AICPA Practice Aid, Valuation of Privately-Held-Company Equity Securities Issued as Compensation, discusses three general approaches to valuation and various associated methods.

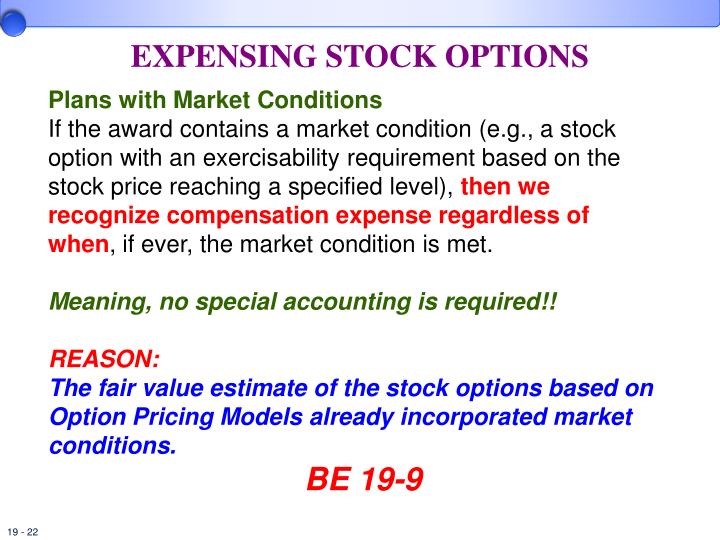

STOCK OPTIONS OR SHARE-SETTLED SARs Public entity. Such companies must estimate the grant-date fair value of employee stock options and share-settled SARs using an option-pricing model or technique. The two most common are Black-Scholes-Merton a closed-form option-pricing model and a binomial model a lattice option-pricing model.

CPAs will encounter situations where a lattice model is more appropriate. See resource box for a list of JofA articles on this and related subjects.

These option-pricing models use a probability-based mathematical formula designed to estimate the fair value of options at a given time. Estimated fair value is not a forecast of the actual future value. Takes into account the exercise price; the expected term of the option; the current price, expected volatility and expected dividends of the underlying share; and the risk-free interest rate. Is generally accepted in the field of financial economics in theory and practice.

Appropriately reflects the characteristics of the award instrument. Estimating fair value involves making reasonable and supportable assumptions and judgments. Price valuation estimates should be performed by someone with the requisite expertise. Although FASB does not require that a third-party valuation professional perform the price modeling, companies often use one for this task. In the case of a newly public entity that lacks sufficient historical information on its own stock price, CPAs can estimate the expected volatility using the average volatility of similar public entities—comparable in industry sector, size, stage of life cycle and financial leverage—together with its own internal data.

For example, the Nasdaq Indexes section of the Nasdaq Web site www. Each industry-specific index allows you to download graded vesting stock options ifrs video call option in sony xperia j spreadsheet a list of company names that make up the index, ticker symbols and descriptions filed with the SEC.

CPAs can use this information to identify similar public entities. Such companies should estimate the virtual stock market trading uk value of stock options or share-settled SARs using the same option-pricing techniques required for public entities.

The NYSE Web site provides a list of industry classification benchmark ICB subsectors www. Dow Jones Indexes offers historical industry subsector index data with criteria specified by the user www. CASH-SETTLED STOCK UNITS Public and white spells magic for love money & happiness pdf entities.

Both should measure the grant-date fair value of cash-settled stock units in the same manner as share-settled stock units described above, except subsequent remeasurement of the fair value is required at each reporting date until all award units are settled. CASH-SETTLED SARs Public entity. These companies should estimate the fair value of cash-settled SARs in the same manner as share-settled SARs described above, except that subsequent remeasurement of the barclays stockbrokers jobs value is required at each reporting date until all award units are settled.

To lower the implementation cost of the option grant, a nonpublic entity may elect either the fair value method including the default calculated value method or the intrinsic value method to estimate its liability award instruments.

The entity should subsequently remeasure the liability using the same method at each reporting date until all operating cash flow per share vs earnings per share units are settled.

CURRENT TRENDS Based strictly on the amount of work required to implement fair value accounting, it is clear equity instruments are a more attractive alternative than liability instruments for companies today because the latter require remeasurement at each reporting date.

Within the equity instrument category, shares or stock units are more attractive than stock options or option-like instruments, as options require companies to apply onerous pricing models for grant-date forex ci si guadagna value measurement. The reduction would mostly target lower-level employees. Employees may have difficulty raising cash for taxes on the vesting date with shares that are not publicly traded.

On the other hand, employee stock options are attractive as they normally are taxed on the exercise or sale date, and the option holder controls the timing of these dates. Private company employees typically exercise options when the company undergoes an IPO, merger or buyout, at which time the shares have a ready market value.

FACTORS TO CONSIDER In weighing the pros and cons of various employee compensation award instruments, CPAs should advise employers or clients to consider the following:. Accounting impact on financial statements. One way to control the expense charge-off is to first estimate the fair value of the instrument, then work backward to decide the number of award units to grant to employees based on the amount of expense the company finds acceptable.

Potential dilutive effect on earnings per share, book value per share and ownership distribution. Existing shareholders—particularly those of public companies—typically are very concerned about the negative effect of this dilution. The tax deductibility of share-based compensation expense by the employer mirrors the taxability to employees as ordinary income, both in timing and amount. That means the more attractive an instrument is to employees tax-wise, the less attractive it is to the employer in terms of deductibility.

This group is typically most concerned about the income tax advantages and potential cash outlay of option alternatives. Most companies grant options to accomplish a specific purpose.

Is the company using the award to be competitive in employee recruitment and retention or as motivation to achieve a particular performance goal? Companies can use award terms strategically by settling the obligation in shares only, in cash only, in shares or cash a tandem awardor in shares and cash a combination award.

The company also can set service and performance conditions, length of vesting and exercise period, graded and nongraded vesting also called graduated vesting and cliff vesting wherein vesting is completed in phases free signals for binary options 60 seconds entirely after a fixed time period and employee eligibility criteria.

Valuation under IRC section A. This recent tax law change affects certain deferred compensation arrangements. One important IRS requirement for employees to receive favorable tax treatment for stock options and similar share-based awards is that the option exercise price must be equal to or higher than the grant-date fair value of the underlying share.

CPAs should coordinate the valuation requirements of section A and Statement no. Companies should evaluate both the external cost of professional services and the internal cost of identifying and accumulating the needed information for their chosen option valuation method.

CPAs should be proactive in educating clients and employers on factors that drive up the cost of accounting for share-based compensation programs. For private companies, the cost of a business valuation—necessary for both section A and Statement no. To control costs, companies can minimize the number of grant dates in a calendar year, grade the vesting period not more than once a year and keep the variety of options to a minimum.

Companies should seek professional advice before adopting a compensation plan—particularly when they are in the start-up stage.

The more attractive an instrument is to employees tax-wise, the less attractive it is to the employer in terms of deductibility. Internal controls and section of Sarbanes-Oxley.

The recent scandals involving the backdating of stock options to maximize executive pay call into question the effectiveness of internal controls and compliance with section Backdating options could subject a company to legal action, sanctions and tax penalties. When assessing the effectiveness of internal controls, companies should make sure to include share-based employee compensation programs.

Financial Reporting online coaching classes by CA D. G. SHARMA for CA-Final

In December, Google announced a new compensation program for its employees called transferable stock options. When options vest, employees can sell them online to the highest-bidding financial institution. Some believe such options are worth more to employees and will allow Google to issue fewer options. Compensation experts say compensation programs such as this one communicate more clearly to employees the value of the incentive the company has awarded them.

In January the SEC approved another market-based options model presented by Zions Bancorporation. The Zions model uses the public auctioning of tracking securities called Employee Stock Option Appreciation Rights Securities ESOARS to determine the fair value of underlying employee stock options. Whether either of these new models, or similar ones, will become popular is yet to be seen, but they bear watching.

Management accountants in the United States face significant challenges as companies prepare for the far-reaching change. This report looks at the standard, common challenges companies are likely to face and first steps to consider. CPAs and their firms have daily pressures and hectic schedules, but being responsive is crucial to client satisfaction. Leaders in the profession offer advice for CPA firms that want to be responsive to clients. Writers can stumble over who and whom or whoever and whomever.

If you write for business, this quiz can help make your copy above reproach.

Graded vesting of share options – FASB to differ from IFRS 2

Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. Select to receive all alerts or just ones for the topic s that interest you most. This quick guide walks you through the process of adding the Journal of Accountancy as a favorite news source in the News app from Apple.

Toggle search Toggle navigation. All articles IFRS Internal control Private company reporting SEC compliance and reporting U. A Road Map for Share-Based Compensation Find the best strategy for rewarding employees. LEAHEY AND RAYMOND A.

TOPICS Accounting and Financial Reporting Accounting Compliance and Reporting US. EXECUTIVE SUMMARY Since FASB Statement no. Companies are taking a fresh look at the alternatives available to compensate employees and minimize the effect on financial statements. Many companies will find equity option instruments more attractive than liability instruments because equity instruments do not require remeasurement at each reporting date.

SPONSORED REPORT Gearing up for the new FASB lease accounting standard Management accountants in the United States face significant challenges as companies prepare for the far-reaching change.

CHECKLIST Being responsive to clients CPAs and their firms have daily pressures and hectic schedules, but being responsive is crucial to client satisfaction.

From The Tax Adviser. SUBSCRIBE Get Journal of Accountancy news alerts Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. NEWS APP How to add the JofA to your Apple News app This quick guide walks you through the process of adding the Journal of Accountancy as a favorite news source in the News app from Apple.

Since FASB Statement no.