Bakken oil stocks to buy

How has that slide affected the energy sector? Let us count the ways. Evaporated, as the price of oil fell below the cost of extracting it for many companies. And energy stocks as a whole?

Bakken Stocks | Investment insight on the bakken landscape

Energy investors have been starved for good news—and this spring they got some. Many analysts believe prices have stabilized, and if true, that could bring a gusher of opportunity. That said, would-be investors should proceed under a caution flag. And even if the increase accelerates, not all oil and gas stocks will benefit equally.

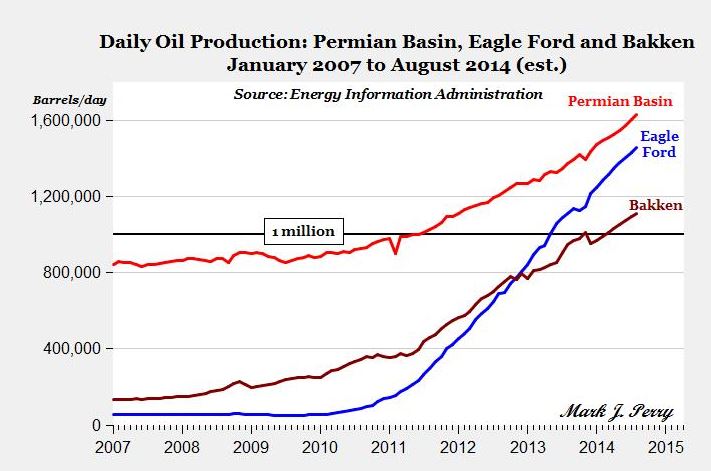

The oil-price crash, of course, was the result of an oil glut. When prices were high, producers launched countless new projects—with U.

That brought a flood of new supply to the market just as the global economy—and global demand for oil—began to weaken. Prices plummeted, but few producers were willing to slow their pumping; many needed to bring in as much cash as possible to service their debt.

In the first quarter of this year, oil companies blinked en masse, reducing output in the face of big losses. In March, oil inventories finally fell, reversing a yearlong trend.

Demand is rising too: Goldman says China and other emerging markets are using more oil than analysts had anticipated, while low gas prices are encouraging American consumers to drive more than ever. For investors, the two urgent questions are: Is a company above breakeven? And if not, can it keep up with its debt payments while it waits for profitability?

Given these criteria, Waghorn of Guinness Atkinson is a fan of Hess hes. About two-thirds of its crude production comes from the U.

KMI Stock: Kinder Morgan Makes a Big Bakken Bet | InvestorPlace

And its current debt-to-Ebitda ratio of 2. Dowd of Fidelity singles out EOG Resources eog.

EOG, too, gets much of its oil from fracking, but it has invested particularly heavily in scientists and technology to help it drill more accurately. A better climate for oil producers is also good news for oilfield servicers.

The producer finds the right location to drill and finances the operation, but the servicer provides the tools and people to build, maintain, and test those wells.

“Three Bakken Stocks Below $10 to Buy Right Now” (Part One) | Stock Gumshoe

The company has absorbed a blow to revenue as the industry struggled—in it posted its first annual loss in more than a decade—and it suffered a setback this spring when an attempted merger with rival Baker Hughes fell through. But Halliburton increased its market share during the oil slump, and it should thrive when U. For more on the energy industry, watch this Fortune video: For now investors should avoid pure-play downstream companies like Marathon Petroleum mpc , which has focused on refining, retail gas sales, and transport since being spun off from Marathon Oil mro in Who Wins When Oil Rises?

The oil-price rebound has sparked a recovery for energy stocks. Still, until the global economy gets stronger, the rally will leave some parts of the industry behind.

WINNING Exploration and Production. The companies that extract oil and control access to reserves are the ones whose fortunes most closely track the price of oil. Oil giants like Shell rdsa , Exxon Mobil, and BP mro do plenty of exploration and drilling. HURTING Refiners and Transporters.

Companies that refine and sell petroleum products pay market price for oil, so their costs are rising, but a shaky economy makes it harder for them to pass costs on to customers. A version of this article appears in the June 15, issue of Fortune with the headline "Cleaning up After an Oil Glut. Snapchat In a Twist, Snapchat Rolls Out a New Feature Similar to One Already on Facebook.

This Bakken Shale Oil Stock Doubled in , but It Has Plenty of Fuel for Another Run in -- The Motley Fool

Jamie Chung—Trunk Archive; Styling: Four Stocks That Should Rise as Oil Rebounds. Retirement The Best Ways to Invest in Bonds Now.

The Best Ways to Invest in Bonds Now. Customer Service Site Map Privacy Policy Advertising Ad Choices Terms of Use Your California Privacy Rights Careers.

All products and services featured are based solely on editorial selection. FORTUNE may receive compensation for some links to products and services on this website. Quotes delayed at least 15 minutes. Market data provided by Interactive Data. ETF and Mutual Fund data provided by Morningstar , Inc. Powered and implemented by Interactive Data Managed Solutions.