Options vertical call spread

The vertical spread is one of our favorite strategies on the site. A vertical spread can be bullish or bearish and can be for debit or credit. A vertical spread, as used on the site, is primarily a directional play. A vertical spread that is positive or negative delta will remain so no matter where stock moves. Unless one of the options is at-the-money and the other far from it, changes in volatility will not have a huge effect on a vertical spread.

There are a few reasons you might use a vertical spread rather than simply buying or selling a call or put in order to take advantage of a predicted directional move. For one, vertical spreads have limited risk. The most you can lose on a debit vertical spread is the amount paid. The most you can lose on a credit spread is the difference between the two strikes minus the credit received.

Realtime Option Strategy Screeners and Analyzers for American Stock Exchanges

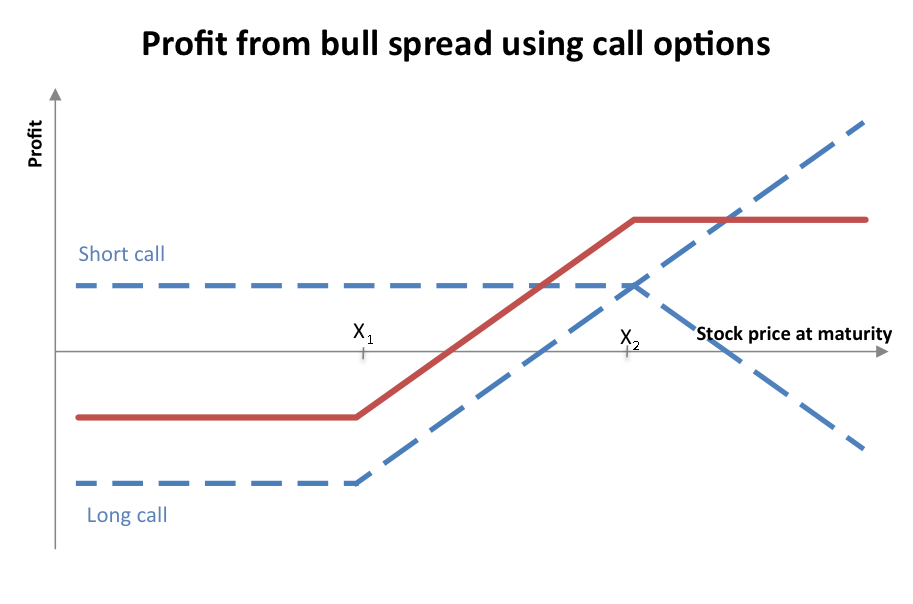

The flip side of this mitigated risk is that profits too are limited. The maximum return on a debit vertical spread is the difference between the strike prices minus the amount paid and for a credit vertical spread the maximum return is the credit received. Graph of bull vertical spread and bear vertical spread from Sheldon Natenberg, Option Volatility and Pricing, p. Secondly, vertical spreads can lower premium in a high volatility environment.

If you expect a move in an underlying, the likelihood is the market does too and implied volatility may be high making options expensive. By buying and selling an option you get to take advantage of a bit of that high premium in the sale.

Vertical Spread

If volatility comes in, both options are affected so the loss of premium on your bought option is somewhat mitigated. Say we are bullish on an underlying, and want to put on a vertical spread. Buying the lower strike and selling the higher strike is always bullish regardless of whether it is a call spread or a put spread.

Generally, we will use a bull call spread when we are expecting a large move around an event. Anticipating an event, the options will have a high premium so a vertical spread is a good strategy. We will look for a call spread that has a good ratio of cost to potential profit, usually 1: With our bull call spreads we are generally looking for good leverage on what we think will be an outsize move in a certain direction.

If we think an underlying is going up, but maybe not dramatically, we might put on a bull put spread. The maximum profit may not be as high, but we only need stock to go up any amount for the maximum return which is the credit received. We can reverse this logic if we are bearish on an underlying and considering a bear call spread credit or a bear put spread.

Remember that the better the leverage the lower the probability.

Learn Option StrategiesIn response to a question about how to choose options for a bull put spread, we had the following response:. The biggest consideration in a bull put spread would be reward to risk.

You want to look at what you would be receiving in credit for the put spread, your max return, versus the difference between the strikes, your maximum loss. Often bull put spreads are done using the at-the-money or close to at-the-money options for the higher put. At-the-money options are most affected by decay and falling volatility theta, vega.

For the put you buy, you have to consider your conviction and risk tolerance. For probability you can take a look at the delta of the lower put, this will tell you the probability that this put will end up in the money. You also might consider sentiment in the underlying, if there are certain resistance points to the downside.

You also want to consider time frame. Do you expect stock to go up right away or long-term and do you want to avoid the volatility of certain events in between? You just need to get direction right. Also a bull put spread is something you might want to manage and have cut off points where you might take it off or roll it out to a different month if stock starts going against you.

With events the stock really could go either way so we like to have a bigger reward to risk ratio than what you can get with a credit spread.

But the bull put spread is a great strategy if you fundamentally think stock is going up. For more about bull put spreads and bear call spreads see this post. Home About Subscribe Login. Which vertical spread to use?

Vertical Call Spread

Why use a vertical spread? How do you decide which vertical spread is best? In response to a question about how to choose options for a bull put spread, we had the following response: Terms Privacy Payment Policy Help Sitemap.