Forex macd divergence trading

Some foreign exchange traders regard oscillator divergences as the holy grail of technical analysis. Others consider these elusive chart patterns to be virtually useless. The truth probably lies somewhere in between.

The purpose of classic divergence is to recognize a technical imbalance between price and oscillator, with the assumption that this imbalance will signal an impending directional change in price. The first trade turned out like a dream. The second left much to be desired. For related reading, Moving Average Convergence Divergence - Part 1 and Part 2 and Trading The MACD Divergence.

The Setup For the first signal in dark redwhich occurred between November and December ofwe have almost a textbook case of classic bullish divergence. Price drastically hit a lower low while the MACD histogram printed a very obvious higher low.

According to proponents of divergence trading, this type of price-oscillator imbalance foretells a price correction of the imbalance. In this case, the correction in price would need to have been a directional change to the upside. That is exactly what happened.

Like clockwork, as evidenced by the chart above, price turned up in early December and did not look back until the second divergence was completed. This first divergence signal was so strong that there was even a mini divergence shown in Figure 1 with dark red dotted lines within the larger divergence that helped to confirm the signal to go long.

Luckily, some of the subsequent bull run was caught as a result of spotting this very clear divergence signal early on. Anyone who caught this particular divergence play was richly rewarded with almost immediate profit gratification. Below, we will explain the method I used to trade it. The Trade The second divergence signal seen in dark bluewhich occurred between mid-December and mid-Januarywas not quite a textbook signal.

While it is true that the contrast between the two peaks on the MACD histogram's lower high was extremely prominent, the action on price was not so much a straightforward higher high as it was just one continuous uptrend. In other words, the price portion of this second divergence did not have a delineation that was nearly as good in its peaks as the first divergence had in its clear-cut troughs. For related reading, see Peak-and-Trough Analysis. Whether or not this imperfection in the signal was responsible for the less-than-stellar results that immediately ensued is difficult to say.

Any foreign exchange trader who tried to play this second divergence signal with a subsequent short got whipsawed about rather severely in the following days and forex macd divergence trading. However, exceptionally patient traders whose last stop-losses were not hit were rewarded with a near-top shorting opportunity that turned out to be almost as spectacularly lucrative as the first divergence trade.

The second divergence trade did not do much for from a pip perspective.

Moving Average Convergence Divergence (MACD)

Nevertheless, a very significant top was undoubtedly signaled with this second stock market gais history, just as a bottom was signaled with the first divergence trade.

To read how to make fake money for vending machines another trading lesson learned in hindsight, see Tales From The Trenches: Making a Winning Divergence Trade So how can we best maximize the profit potential of a divergence trade while minimizing its risks?

First of all, although divergence signals may work on all timeframes, longer-term charts daily and higher usually provide better signals. As for entries, once you find a high-probability trading opportunity on an oscillator divergence, you can scale into position using fractionally-sized trades.

This allows you to avoid an overly large commitment if the divergence signal immediately turns out to be false.

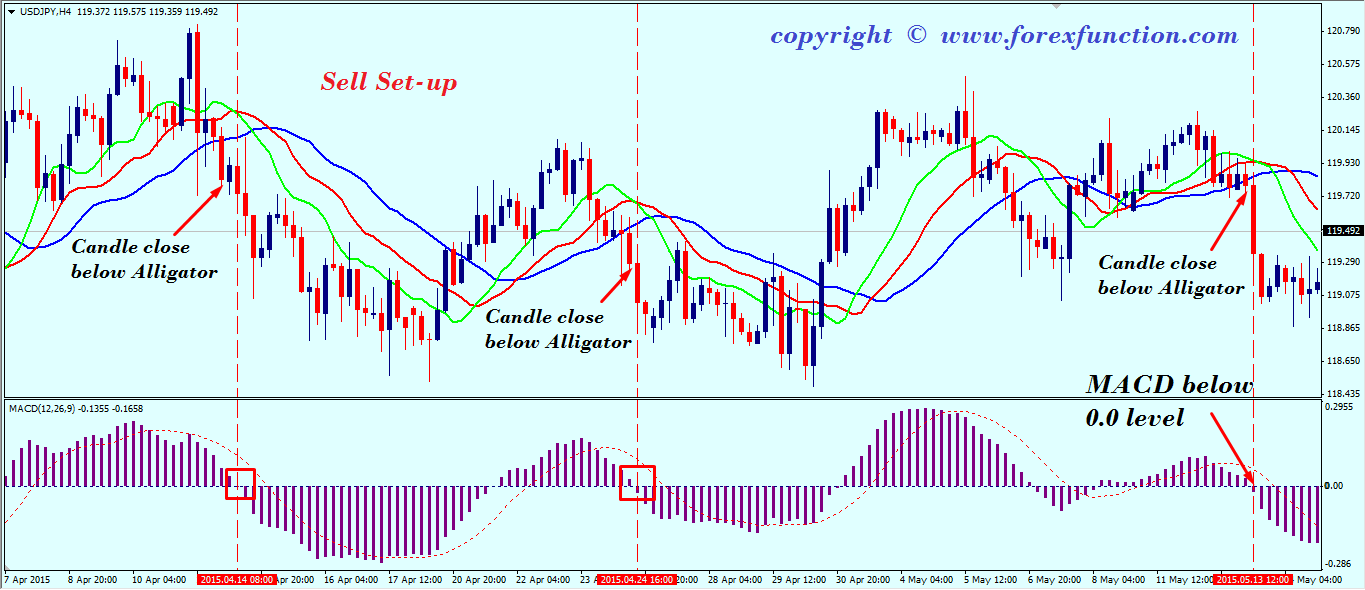

MACD Divergence Forex Trading Strategy

If the trade becomes favorable, on the other hand, you can continue to scale in until your intended trade size is reached. If momentum continues beyond that, you should hold the position until momentum slows or anything larger than a normal pullback occurs. At the point that momentum wanes, you then scale out of the position by taking progressive profits on your fractional trades.

A Lesson Learned So what can we learn from all of this? It is pretty safe to say that there is at least some validity to oscillator divergence signals, at least in the foreign exchange market.

If you look at the recent euro exchange rate icici bank of the major currency pairs, you will see numerous similar signals on longer-term charts like the dailythat can provide concrete evidence that divergence signals are often exceptionally useful.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Adoption attachment strategies Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Trading Divergences In Forex By James Chen Share. FX AccuCharts, courtesy of FX Solutions Figure 1 The Setup For the first signal in dark redwhich occurred between November and December ofwe have almost a textbook case of classic bullish divergence. MACD divergence is a popular method for predicting reversals, but unfortunately it isn't very accurate.

Learn the weaknesses of indicator divergence. Divergences may signal a change in market direction, but traders must also identify the speed of that change. Currency traders can use this method to avoid stop-order triggers before the real reversal. Knowing when trends are about to reverse is tricky business, but the MACD can help.

Trading Divergences In Forex

Pay attention to how the exhaustion principle helps technical indicators signal trend reversals when abrupt value changes coincide with high trading volume. When the On Balance Volume indicator posts a new high while a stock struggles at lower price levels, it predicts a bullish game of catchup.

Learn about this momentum indicator that shows the relationship between two moving averages. Learn about market wave, the second screen in this three-part system. Using the simple MACD histogram could change how forex traders analyze currency pairs for good. Traders can use "the usual suspects" standard indicators for trend trading when it comes to choosing indicators for investing in commodities.

In technical analysis, most indicators can give three different types of trading signals: Learn some of the principle strategies traders can employ after spotting a divergence between technical indicators on a price Discover common divergence strategies that utilize either stochastics or the MACD, the two most frequently used momentum Use divergence indicators to identify market tops or bottoms, and find out how trading divergence strategies are used in Learn how to spot divergence using oscillators such as the relative strength index and money flow index, and see how to profit Learn what technical analysts mean by a "divergence" between indicators, and determine why a divergence could be a sign the An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

MACD - How To Use The MACD Correctly

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.