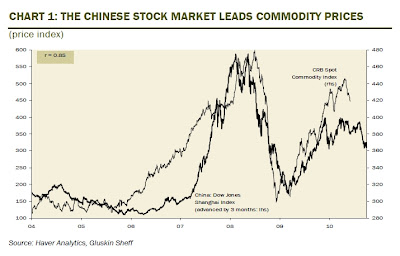

Commodities stock market correlation

Intermarket Relationships: Following The Cycle

In the forex market, we often discuss the concept of correlated pairs. This is because, inevitably, a currency must be paired with another currency to determine its relative value at any given point.

Error (Forbidden)

In the futures market, this value is derived from the dollar because it is the reserve currency of the world and has been since The relationship in play is market correlation.

Our approach here helps answer the age-old question of whether a particular day is a good trading day — or not. In a good trading day, related markets are expected to rise based on the relevant fundamentals. Traders seeking to take advantage of this relationship will place long positions in the appropriate markets.

On the other hand, during bad trading days some markets are ripe for short positions, or they should be avoided altogether as these relationships tend to be less predictable. First, the trends typically tend to be less volatile and more reliable.

The Relationship Between Stock And Commodity Returns Depends On The Country | Seeking Alpha

When positively correlated markets are rising, they often do so in a more controlled fashion. Simply put, profits are easier to come by for traders, particularly those with less experience, who focus on exploiting bullish tendencies rather than price breaks lower.

A trader can view the futures market prior to market open pre-market and get a sense, using key fundamental relationships, to detect the underpinnings of a good trading day.

Once a day is identified as a possible good or bad trading day, you know how to approach it. Either you will press your advantage as trends develop, or you will sit on the sidelines and wait for a safer opportunity. Keep in mind that trading days can change. Many things can happen during the course of a trading day; for example, a geopolitical event can occur without warning. Seeing this and changing course if need be, though, is all part of being a trader.

Stock Market Vs. Commodity Market | Finance - Zacks

Your immediate goal is recognizing key fundamental relationships that can set the tone. Four strongly related markets for determining that tone are financials, crude oil, stock indexes and metals. By financials we mean the U.

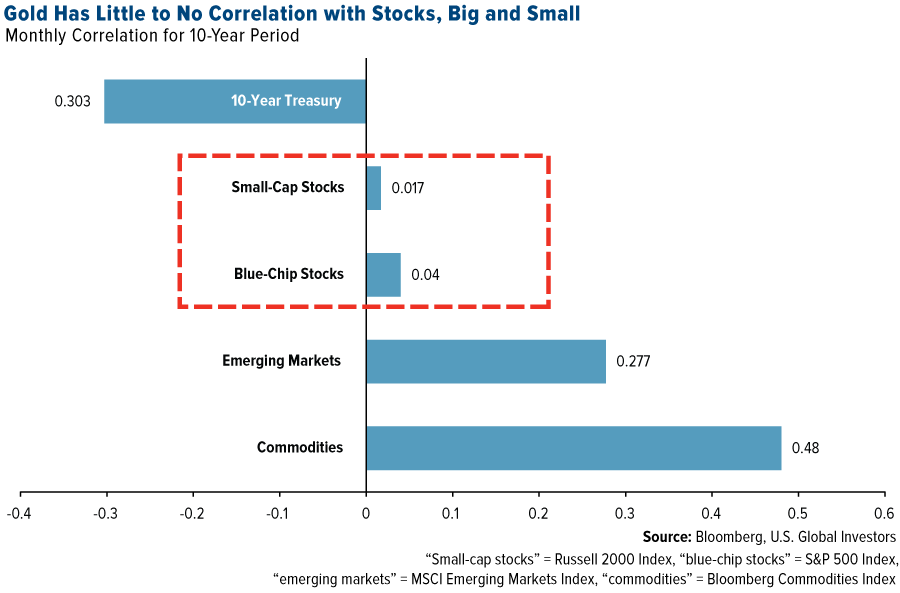

By metals, we are referring to gold. Free Newsletter Modern Trader Follow. We asked traders what FBI Director Comey's testimony means for stocks and other markets. Silver holding huge commercial short. Retail is in trouble because of economic conditions.

How Commodity Prices Impact Stock PricesWhat does this mean for the markets? Election play in gold options. How to exploit and profit from market correlation FROM ISSUE. Fundamental ties A trader can view the futures market prior to market open pre-market and get a sense, using key fundamental relationships, to detect the underpinnings of a good trading day.

Page 1 of 4. Short-term signals in E-minis, crude and gold.

The age old question. A better measure of risk. Scaling into reversals to gain an edge.

Unlocking the mystery of building trading strategies. The age old question Sortino ratio: Previous Scaling into reversals to gain an edge. Next Unlocking the mystery of building trading strategies.