Why is it not optimal to exercise an american call option early

April 1, by TradingMarkets Editors. While the math behind options pricing models may seem daunting, the underlying concepts are not. The first three deservedly get most of the attention, because they have the largest effect on option prices. But it is also important to understand how dividends and interest rates affect the price of a stock option. It is also these two variables that are crucial to understanding when to exercise options early.

The Black-Scholes model The first option pricing model, the Black-Scholes model, was designed to evaluate European-style options, where early exercise is not permitted. So Black and Scholes never addressed the problem of when to exercise an option early and how much the right of early exercise is worth.

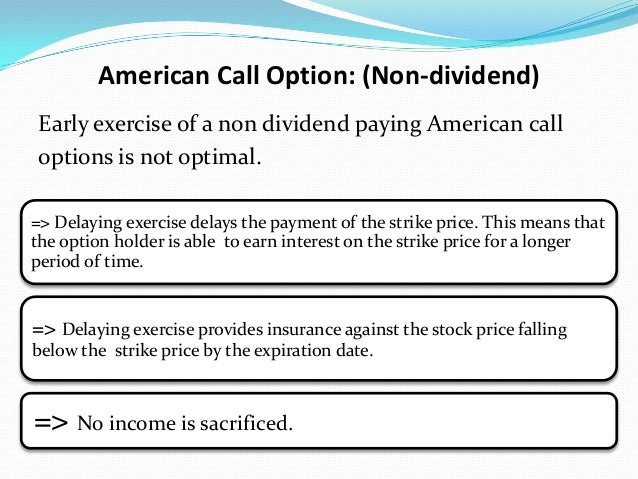

Being able to exercise an option at any time should theoretically make an American-style option more valuable than a similar European-style option, although in practice there is little difference in how you trade them.

Because stock options are American-style, and carry with them the right of early exercise, different models were developed to accurately price them. Most of these are refined versions of the Black-Scholes model, adjusted to take into account dividends and the possibility of early exercise.

To appreciate the difference this can make, you first need to understand when an option should be exercised early. The role of interest rates in determining when to sell early The short answer as to when you should exercise an option early is: That may seem obtuse, but as we go through the effect interest rates and dividends have on option prices, I will also bring in a specific example to show when this occurs.

An increase in interest rates will drive up call premiums, and cause put premiums to decrease. To understand why, you need to think about the effect of interest rates when comparing an option position to simply owning the stock. Since it is much cheaper to buy a call option than shares of the stock, the call buyer is willing to pay more for the option when rates are relatively high, since he can invest the difference in the capital required between the two positions.

Interest rates have been steadily falling in the United States, to the point where the current Fed Funds target is down to 1. With the short-term rates available to individuals of around 0. Interest rates are the critical factor in determining whether to exercise a put option early. A stock put option becomes an early exercise candidate anytime the interest that could be earned on the proceeds from the sale of the stock at the strike price is large enough.

Determining exactly when this happens is difficult, since each individual has different opportunity costs, but it does mean that early exercise for a stock put option can be optimal at any time provided the interest earned becomes sufficiently great. Cash dividends affect option prices through their effect on the underlying stock price. Because the stock price is expected to drop by the amount of the dividend on the ex-dividend date, high cash dividends imply lower call premiums and higher put premiums.

While the stock price itself usually undergoes a single adjustment by the amount of the dividend, option prices anticipate that dividends will be paid in the weeks and months before they are announced.

The dividends paid should be taken into account when calculating the theoretical price of an option and projecting your probable gain and loss when graphing a position. This applies to stock indices as well.

Dividends are critical to determining when it is optimal to exercise a stock call option early, so both buyers and sellers of call options should consider the impact of dividends. Whoever owns the stock as of the ex-dividend date receives the cash dividend, so owners of call options may exercise in-the-money options early to capture the cash dividend.

Why Pullups Should Be Part of Your Weekly Exercise

That means early exercise makes sense for a call option only if the stock is expected to pay a dividend prior to expiration date. But recent changes in the tax laws regarding dividends now mean that it may be two days before now, if the person exercising the call plans on holding the stock for 60 days to take advantage of the lower tax for dividends. Example Say you own a call option with a strike price of 90 that expires in two weeks. The call option is deep in-the-money, and should have a fair value of 10 and a delta of So the option has essentially the same characteristics as the stock.

There are three possible choices of what to do 1. Do nothing hold the option. Exercise the option early. Sell the option and buy shares of stock. Which of these choices is best? If you hold the option, it will maintain your delta position. That is not because of any additional profit, but because you avoid a two-point loss. You must exercise the option early just to ensure you break even.

What about the third choice, selling the option and buying stock? This seems very similar to early exercise, since in both cases you are replacing the option with the stock. The decision of which to do depends on the price of the option.

Why Your Brain Needs More Downtime - Scientific American

In this example, we said the option is trading at parity 10 so there would be no difference between exercising the option early or selling the option and buying the stock. But options rarely trade exactly at parity. So the only time it makes sense to exercise a call option early is if the option is trading at, or below, parity, and the stock goes ex-dividend tomorrow. Summary While interest rates and dividends are not the primary factors affecting an options price, an option trader should be aware of their effects.

In fact, the primary drawback I have seen to many of the option analysis tools available is that they use a simple Black Scholes model and ignore interest rates and dividends.

You can find more valuable options trading information at www. Recent , Trading Lessons , Trading Lessons.

ConnorsRSI is the first Quantified Momentum Indicator -- the next-generation improvement to traditional RSI indicators. At Connors Research, we are using it as an overlay to many of our best strategies to make them even better -- now you can, too.

Why Extreme Exercise May Harm Your Heart

Enter your email address to get your FREE download of our Introduction to ConnorsRSI - 2nd Edition - Trading Strategy Guidebook with newly updated historical results. The Connors Group, Inc. About Careers Contact Us Testimonials Link To Us.

TradingMarkets PowerRatings Connors Research. ConnorsRSI Learn More About ConnorsRSI Recent Articles Store Books Free First Chapters Free Newsletters PowerRatings Buy the PowerRatings Algorithm Recent Articles.

Home Articles Connors Research ETFs Options Stocks Volatility Contributors Larry Connors Kevin Haggerty Matt Radtke Education Connors Research Glossary Moving Averages Options Options Trading VIX Interview Archive Trading Lessons Videos Guidebooks Courses Newsletters Store June 21, Learn When You Should Exercise an Option Early April 1, by TradingMarkets Editors. Have You Switched To ConnorsRSI?

Company Info The Connors Group, Inc. About Us About Careers Contact Us Testimonials Link To Us. Properties TradingMarkets PowerRatings Connors Research.

The analysts and employees or affiliates of Company may hold positions in the stocks, currencies or industries discussed here. The Company, the authors, the publisher, and all affiliates of Company assume no responsibility or liability for your trading and investment results. Factual statements on the Company's website, or in its publications, are made as of the date stated and are subject to change without notice. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable or that they will not result in losses.

Past results of any individual trader or trading system published by Company are not indicative of future returns by that trader or system, and are not indicative of future returns which be realized by you.

In addition, the indicators, strategies, columns, articles and all other features of Company's products collectively, the "Information" are provided for informational and educational purposes only and should not be construed as investment advice. Examples presented on Company's website are for educational purposes only.

Such set-ups are not solicitations of any order to buy or sell. Accordingly, you should not rely solely on the Information in making any investment. Rather, you should use the Information only as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments. You should always check with your licensed financial advisor and tax advisor to determine the suitability of any investment. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT.

All analyst commentary provided on TradingMarkets. The analysts and employees or affiliates of TradingMarkets.

This information is NOT a recommendation or solicitation to buy or sell any securities. Your use of this and all information contained on TradingMarkets.

Please click the link to view those terms. Follow this link to read our Editorial Policy. Return to top of page.