Income tax unapproved share options

Employee share options are now a standard part of many employment packages. We work with private companies, larger groups and foreign parents looking to roll out a share option plan for UK personnel.

Most of our clients are in competitive sectors where retaining employees is important and they see share options as a tool.

If the value of the shares under the unapproved option increases an employee benefits from the increase.

If the value of the underlying shares drops there is no obligation to exercise the unapproved option. Statistics show that having a stake in the employer company motivates to work towards exit more than a cash bonus. In the case of options which are only exercisable upon sale of the business there may never be need to change the articles.

This is because the option holder exercising upon the sale will only be a shareholder momentarily. Upon sale, exercise is usually wrapped up with the sale documentation to eliminate the risk of the option holder not consenting to the sale. Many employers prefer share options to share awards because they are less risky for the employee and less administratively heavy on the employer.

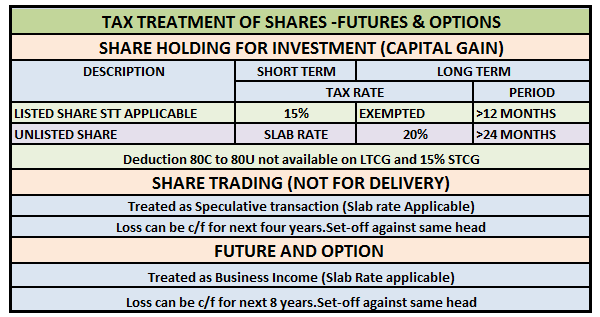

We use our experience to help employers design the best arrangements for their business. For UK resident option holders the gain made on exercise of the unapproved option will be assessed to income tax and usually national insurance.

UK Unapproved Share Options

If the option holder retains the shares acquired on exercise, any subsequent growth in value will be assessed to capital gains tax. However, in our experience, most option holders dispose of their shares acquired on exercise immediately following exercise and lose the benefit of the lower tax rates applicable to capital.

The system for the payment of tax arising on the gain made on exercise varies according to the nature of the shares acquired on exercise. The tax reporting where unapproved options are exercised by consultants and non-executive directors can be tricky and there are grey areas.

PayLessTax How Share Options are Taxed

We do provide specialist advice. Emp Loyee received an unapproved share option over 5, shares.

Share-based remuneration | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global

Two years later Emp Loyee exercises the option over 5, shares. The choice of HMRC approved option plans is comprehensive. Each type of HMRC approved option plan offers different benefits and carries different qualifying conditions. A phantom option does not involve the issue of shares.

What are the options for share options? - Talking Business

The idea is that a cash bonus is paid to an employee which is measured against the performance of shares in the employer or its group. Payment under the phantom option plan is treated as income and subject to income tax and national insurance under PAYE.

A phantom option would be considered where the issue of shares is not desired — usually because of an inability to obtain shareholder approval, for example joint venture companies. We are one of the few boutique commercial solicitors that combines tax, accounting, commercial and employment law expertise. Why not call or email me to arrange an informal discussion