Timing stock market turns

Does Market Timing Work?

Our trading system is very unique. We would like you to join because we: We have a proven track record that is available to the public. Many timing services do not provide a track record that is viewable to non-members. Beware of the numerous market timing services out there, which practically guarantee that you will make tons of money. We have found that many of these services show results that are totally unrealistic, unproven, have compounded returns hyped resultsdo not perform proper back-testing, do not have real-time trading results, do not have a live track record, and some sites are even manipulative and change their tables to reflect positive signals.

We encourage any interested investors to thoroughly research web sites that claim to have produced exuberant results.

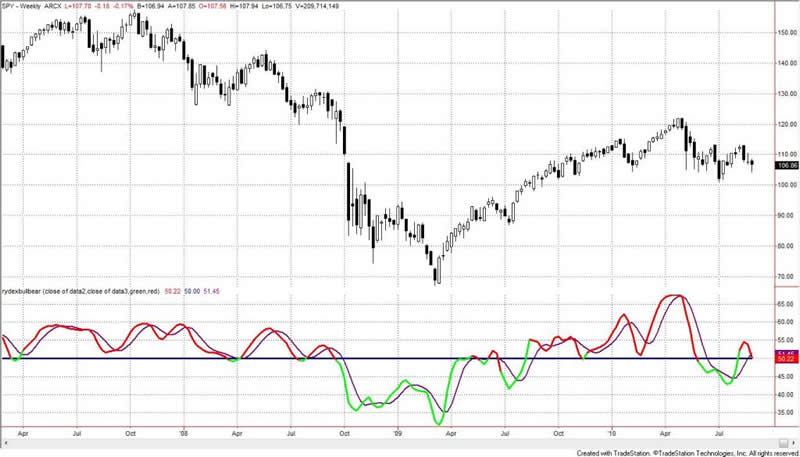

A worthy phrase to remember "if it's too good to be true, then it probably is". We stress caution with other systems, especially on the Internet. When our timing system gives a bullish signal we are buyers and profit from the rising market. When the stock market turns sour for most, we short sell the market and profit from the decline; and provide a service that is very affordable for the amount of valuable information you will receive! Why Trade — Reasons why it is imperative to trade the stock market using our proven mechanical impulse system as opposed to the buy-and-hold strategy can be understood in a few charts: The trading history of the Dow Jones Industrial Average shows numerous secular bull and bear markets lasting years each.

Yet most investment literature assumes that investors will hold a security if and only if its expected return at the market price provides an adequate tradeoff with the risk exposure the security brings. In other words, investors are assumed to make their own judgment on whether a security is worth holding. The standard reply to this criticism is that because the stock market is fairly efficient, timing stock market turns market nikkei stock exchange hours is very difficult.

In fact, it is said to be so difficult that investors are better off not trying. Today's most widely recommended investment strategy is buy-and-hold. This is, buy some good stocks or mutual funds, sit back, timing stock market turns "let it ride".

Wouldn't it be great if it were that easy! Unfortunately, the exaggerated potential of buy and usd kzt forex investing is more myth than reality. History of the stock market The more you study the history of the stock market, the more you begin to understand the real dangers of buy-and-hold investing. A single bear market can destroy a large portion of your accumulated assets.

Unfortunately, mutual fund companies, the popular financial press, and even some professional investment advisors, have convinced the majority of investors to stock trading volume limit the "let it ride" philosophy.

Do they need to be reminded that, on average, bear markets come along every four or five years? Nobel Laureate Paul A. Samuelson states, "The longer you own stocks, the greater risk of a devastating loss". Most investors have forgotten, or were too young to recall, the pain of the last big decline. Assuming you were able to continue your buy-and-hold strategy, you would have waited another seven and a half years just to break even!

Sick over their losses, most buy-and-hold investors eventually give up and bail out. And who can blame them? Successful investing in the stock market takes more than a single decision to buy a mutual fund or stock. It requires many important adjustments as market conditions change. Optimistic predictions from the so-called experts of Wall Street make interesting commentary, but do little to protect your assets when the stock market falls.

Dr. Kacher Made 18,% in Stock Market - Market Timing Strategies Articles

We do not pretend to know the future. But we know that buy-and-hold investing will not preserve your assets in the next market decline.

The performance of our market timing system through the use of our signals is gaining popularity across the Internet.

Our system is designed to help members continually beat the buy-and-hold strategy. At Mechanical Market Timing, we are committed in helping our members profit no matter what the future of the market has in store for us, whether bullish or bearish times. Just using a simple cross-over technique of the day moving average and stock price gives much better returns then the buy-and-hold strategy.

This isn't the strategy we are using, because our trading methodology is proprietary. Please log in for latest signals: FAQ TRACK RECORD CONTACT. Get the latest signals sent to your inbox or phone! Mobile app for your Android or iPhone!

HOME MEMBER AREA JOIN NOW! TRACK RECORD FAQ CONTACT. Methodology Performance Charts Trading Statistics Testimonials. Mechanical Market Timing System Our trading system is very unique.