Forex spot and forward rates

Let's say an investor buys a two-year zero-coupon bond.

Forex Advisors in India | Dollar Rupee Live Rates | Forex Hedging - Forex Capital Services Pvt. Ltd.

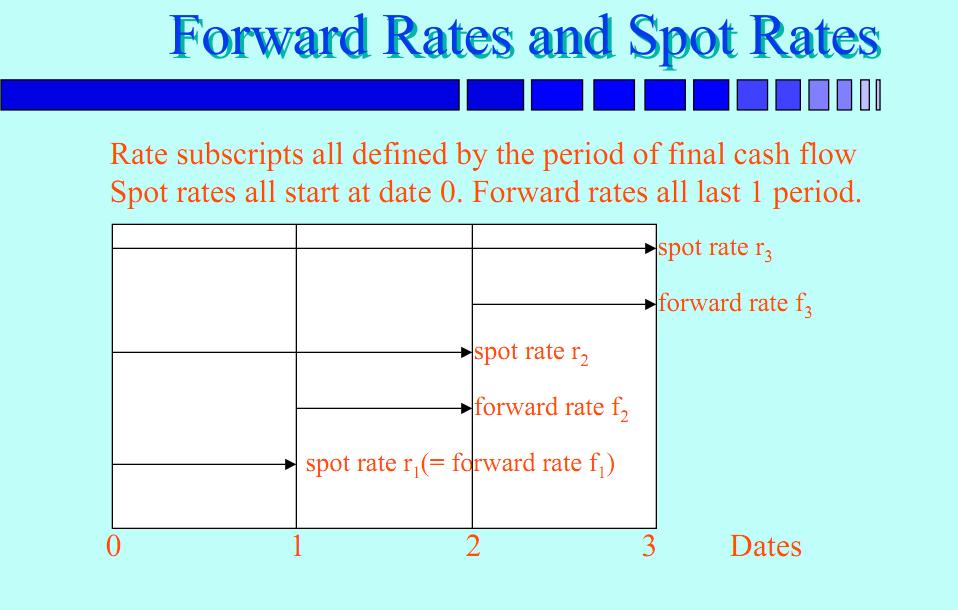

The proceeds will equal: The investor could also buy a six-month Treasury bill and reinvest the proceeds every six months for two years. In this case, the value would be: This equation states that the two-year spot rate depends on the current six-month rate and the following three six-month spot rates.

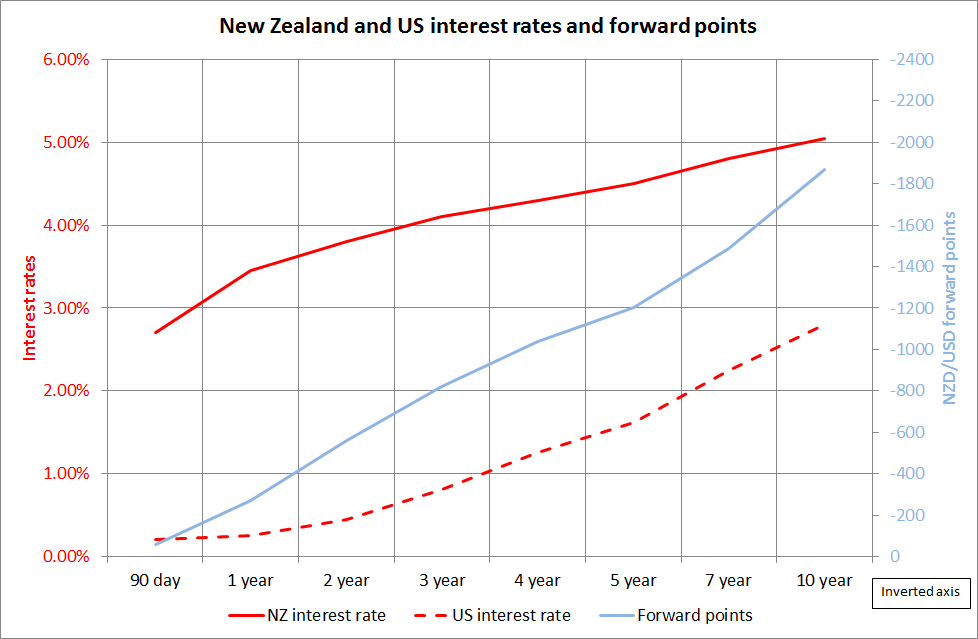

As we can see, short-term forward rates must equal spot rates or else an arbitrage opportunity can exist in the market place. Compute Spot Rates if Given Forward Rates, and Forward Rates if Given Spot Rates Computing a forward rate by using spot rates is covered above. Using spot rates, an investor can develop any forward rate.

There are two elements to the forward rate. The first is when the future rate begins. The second is the length of time for that rate. The notation is length of time of the forward rate f when the forward rate began. For example, a 2 f 8 would be the 1-year two six-month periods forward rate beginning four years eight six-month periods from now. So for a 3f5 it would equal an equation of: Dictionary Term Of The Day.

Spot FX, Forward Swaps & NDF's - Live FX Rates

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Forward Rates vs Spot Rates By Investopedia Share. Chapter 1 - 5 Chapter 6 - 10 Chapter 11 - 15 Chapter 16 - Ethics and Standards 2. Global Economic Analysis 1. Knowledge of the Law 1. Independence And Objectivity 1. Material Nonpublic Information 1.

Loyalty, Prudence And Care 1. Preservation Of Vsa trading forex 1. Duties to Employers, Standard IV-A: Additional Compensation Arrangements 1. Responsibilities Of Supervisors 1. Diligence And Reasonable Basis 1.

Communication With Clients And Prospective Clients 1. Disclosure Of Conflicts 1.

Foreign exchange spot - Wikipedia

Priority Of Transaction 1. Composites And Verification 1. Disclosure And Scope 1. Requirements And Recommendations 1. Fundamentals Of Compliance And Conclusion 2. Real GDP, and the GDP Deflator 4. Pegged Exchange Rate Systems 5.

Fixed Income Investments The Tradeoff Theory of Leverage The Business Cycle The Industry Life Cycle Intramarket Sector Spreads Calls and Puts American Options and Moneyness Long and Short Call and Put Forex spot and forward rates Covered Calls and Protective Puts. To solve for tFm use the following equation: The spot rate is the immediate purchase price posted on exchanges for purchasing commodities, currency and securities.

Learn the basics of forward exchange rates and hedging strategies to understand interest rate parity. Currency risk can be effectively hedged by locking in an exchange rate through the use of currency futures, forwards, options, or exchange-traded funds.

A spot market is a market where a commodity or security is bought or sold and then delivered immediately. The spot, futures and option currency markets can be traded together for maximum downside protection and profit. Spot price is the current price at which a security may be bought or sold.

This article expands on the complex structure of derivatives by explaining how an investor can assess interest rate parity and implement covered interest arbitrage by using a currency forward Examining open interest on currency futures can help you confirm the strength of a trend in forex market sentiment. You may participate in both a b and a k plan.

However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.